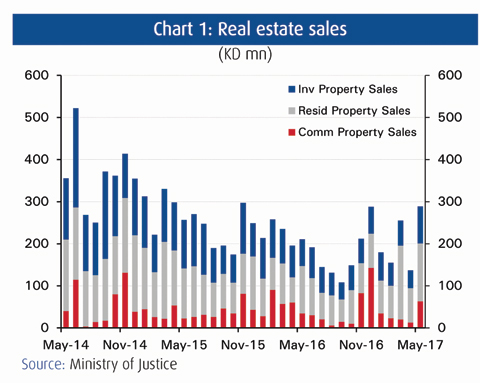

KUWAIT: The real estate market picked up momentum in May. Sales rose to KD 289 million, their highest level in 18 months and up 37% year-on-year (y/y). The residential and investment sectors provided significant support to the real estate market, with sales increasing by 23% and 38% y/y, respectively. Activity has been relatively volatile in recent months, with three of the last six months seeing elevated sales, something that could be signaling an end to the two year slowdown. Real estate prices across most sectors continued to hold steady, currently off 9-10% y/y.

KUWAIT: The real estate market picked up momentum in May. Sales rose to KD 289 million, their highest level in 18 months and up 37% year-on-year (y/y). The residential and investment sectors provided significant support to the real estate market, with sales increasing by 23% and 38% y/y, respectively. Activity has been relatively volatile in recent months, with three of the last six months seeing elevated sales, something that could be signaling an end to the two year slowdown. Real estate prices across most sectors continued to hold steady, currently off 9-10% y/y.

The residential sector bounced back following a soft April. Sales jumped to KD 138 million during the month, on 406 transactions. KD sales improved by 23% y/y, supported by a 46% rise in the number of transactions from a year ago. A surge in home purchases was witnessed during the last two months; 233 and 203 homes were sold in April and May respectively, the highest since March 2015.

Residential real estate prices were flat in May, continuing to show a stabilizing trend. The NBK residential home price index stood at 151.2 point, flat for the month. The index has been stable and in the vicinity of 151-152 points for almost three consecutive quarters, though it remains down 9% y/y. The NBK residential land price index retreated in May to169.1 points and is down 9.5% y/y. Investment sector activity was strong this month, compensating for April's weakness. Sales came in at KD 87.7million, up38% y/y. The number of transactions improved as well, advancing by 10% from the previous year.

Investment building prices logged a slight gain for the month. The NBK investment building price index stood at 185.1 points, up 1.7%for the month, a five months high. The index is down 10% y/y, an improvement from a few months back as it appears also to have bottomed out in tandem with prices in the residential sector. Commercial sector activity picked up this May, following four months of low volume activity. Sector sales reached KD 62.8 million on six transactions; the largest three transactions were a plot in Egaila for KD 28.5 million and two buildings in Sharq for KD 20.4 million and KD 16.8 million.

The slowdown in the real estate market, and the price correction that accompanied it, has started to have an impact on housing rent and consumer inflation. The weak market and a rise in vacant apartments since the end of 2015 have exercised downward pressure on rents though the impact on inflation had been elusive, until recently. Easing rent inflation only became visible in the housing services component of the CPI in March 2017. Housing inflation, mostly comprised of housing rents, slowed from6.4% y/y in 4Q16 to a three-year low of 4.3% y/y in 1Q17.