Kuwait's credit growth weak in October; remains at 4.6% y-o-y

NBK Economic Report

NBK Economic ReportKUWAIT: Credit was weaker than expected in October, though growth rose to 4.6 percent y/y on base effects. The month saw total credit contract by KD 220 million. While some of that was from the usual start-of-quarter drop in securities lending, there was additional weakness in some business sectors. Nonetheless, year-on-year (y/y) growth improved as the impact of last year's Americana-related repayments faded. Private deposits saw a decline on the heels of two strong months.

Household lending was the exception, seeing healthy gains in October. Growth improved slightly to 7.5 percent y/y. Personal facilities excluding securities lending added a net KD 102 million during the month, a figure comparable to levels seen in the months before 2016 and well above the KD 72 million average recorded thus far in 2017.

Business credit (excluding nonbanks) dropped by KD 322 million on the regular start-of-quarter drop in lending for the purchase of securities as well as weakness in some business sectors. Securities lending fell by KD 213 million. Outside that, there were relatively large declines in "other sectors" (-KD 88 million) and construction (-KD 59 million). These were partly offset by gains in industry (+KD 24 million) and trade (+KD 15 million).

Lending to "productive" business sectors was weak, though growth remained relatively robust at 5.7 percent y/y. Productive credit, which excludes real estate and financial sector lending, dropped by KD 112 million during the month. The fading of the large Americana-related settlements made in October 2016 helped boost growth. Still, growth has been weaker in the last few months following a stronger first half of the year.

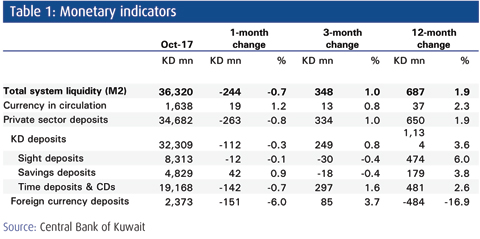

Private deposits were off in October following two months of relatively strong gains. Deposits fell by KD 263 million largely on declines in KD time (-KD 142 million) and foreign currency deposits (-KD 151 million). Money supply (M2) growth slipped slightly to 1.9 percent y/y. Government deposits also declined, losing KD 167 million, as growth slowed to 2.4 percent y/y. The banking system's liquid reserves, or "excess liquidity", edged higher in October to 7.0 percent of bank assets. Bank reserves (cash, deposits with the CBK, and CBK bonds) increased by KD 200 million to KD 4.4 billion. This coincided with the absence of public debt issuance in October. As such, the amount of outstanding domestic public debt instruments (PDIs) dropped to KD 4.77 billion, or an estimated 12 percent of GDP.

Domestic interest rates in October were little changed from September. The 3-month interbank rate edged up 3 basis points to settle at 1.79 percent, though rates have moved higher since. Customer deposit rates were unchanged on the month.

More recently, the Central Bank of Kuwait (CBK) kept the discount rate unchanged following the US Fed's much-anticipated rate hike on 13 December. This was the second time the CBK holds off hiking its key rate during the current Fed cycle of rising rates; it did so also in June 2017. However, the CBK again indicated it might continue to take steps to push bank deposit rates higher while keeping bank lending rates unchanged. The CBK explained that, in keeping the discount rate at 2.75 percent, it sought to avoid stifling non-oil growth while continuing to take further action to maintain the dinar's attractiveness. In this vain, the CBK increased its coupon rate on 3-month bills issued on 19 December by 25 bps to 2 percent.

NBK ECONOMIC REPORT