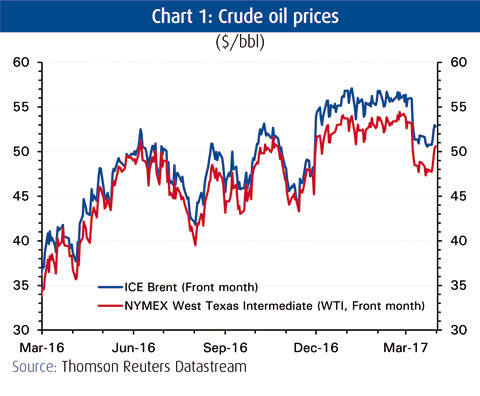

KUWAIT: Oil prices fell to their lowest level in more than 3 months in March amid swelling global crude stocks and rising US shale production. March saw oil prices finally break out of their narrow trading range and fall to their lowest level in more than three months. By the end of March, Brent, the international benchmark, had fallen by 5.0 percent to $52.8 per barrel (bbl) and West Texas Intermediate (WTI), the US marker, had declined by 6.3 percent to $50.6/bbl. At one point, around mid-month, Brent looked likely to reverse all the gains it had posted since 30 November, the date of the symbolic OPEC/non-OPEC production cut agreement. WTI actually breached its 3.5-month floor, dropping to a low of $47.3/bbl on the 21 March.

KUWAIT: Oil prices fell to their lowest level in more than 3 months in March amid swelling global crude stocks and rising US shale production. March saw oil prices finally break out of their narrow trading range and fall to their lowest level in more than three months. By the end of March, Brent, the international benchmark, had fallen by 5.0 percent to $52.8 per barrel (bbl) and West Texas Intermediate (WTI), the US marker, had declined by 6.3 percent to $50.6/bbl. At one point, around mid-month, Brent looked likely to reverse all the gains it had posted since 30 November, the date of the symbolic OPEC/non-OPEC production cut agreement. WTI actually breached its 3.5-month floor, dropping to a low of $47.3/bbl on the 21 March.

Triggering the decline were doubts about OPEC's capacity to materially reduce the still sizeable overhang of crude inventories, especially in the US, where crude stocks were hitting record highs for 9 consecutive weeks amid a resurgence in light tight oil (LTO, or shale) production. The positive sentiment that had propelled oil prices more than 20 percent since the eve of the OPEC agreement quickly turned bearish, with many of the hedge fund managers and speculators that had amassed record long bets in futures and options contracts reversing course and unwinding their positions.

Markets were especially alarmed when Saudi Arabia disclosed that it had officially increased crude production in February to 10 million barrels per day (mb/d). The rise was a sizeable 260,000 b/d on January's figure, and more than offset the entire volume decrease by the other OPEC members working towards their reduced output targets, as per the OPEC agreement. Moreover, Saudi Arabia, seemed to be signaling to its OPEC and non-OPEC counterparts that it was losing patience with non-compliant producers-those who had yet to bring crude output down to within their allotted quotas.

Saudi burden of OPEC production

Saudi Arabia, which had, as of February, overachieved by cutting 150 percent of its target amount, according to OPEC secondary source data, has effectively been shouldering the burden for all but one of its members (Angola). Compliance among the 10 OPEC members subject to production cuts was 110 percent in February, with Kuwait close behind Angola at 98 percent. But combined OPEC output, at 31.96 mb/d, was still 210,000 b/d above the group's target thanks to increased production from the three members, Libya, Nigeria and Iran. The three are exempt from cuts.

Meanwhile, among the 11 non-OPEC producers party to the agreement, compliance was at 44 percent in February, according to International Energy Agency (IEA) figures. Russia, Mexico, Kazakhstan and a host of smaller nations had pledged to cut output collectively by 558,000 b/d. As of February, these producers had only brought production down by 248,000 b/d. Only Oman and Brunei have met their obligations.

Were OPEC and non-OPEC producers to make good on their promises by the time the agreement expires in June, then around 1.8 mb/d of crude could be withdrawn from the oil markets. In tandem with an expected acceleration in global demand growth this year, to a high of 1.5 mb/d in 3Q17, the demand-supply balance should remain in deficit for at least the first half of this year-and likely all of 2017 if OPEC/non-OPEC decide to extend the production cut agreement beyond the summer.

OPEC output cut deal

Such a prospect is looking increasingly likely given the slower-than-expected unwinding of global crude stocks. The drawdown in commercial crude and petroleum product stocks, which had been gaining momentum in the second half of 2016, abruptly ended in January with a 48 million barrel inventory build. The rise, which came after US crude stocks reached another record high, pushed total OECD stocks back over the symbolic 3 billion barrel level again. (Chart 6.) Stocks are at least 270 million barrels above their 5-year average of 2.75 billion barrels, which is the level that OPEC appears to be targeting.

While Kuwait was the first among OPEC members to call for an extension to the 6-month agreement, Saudi Arabia and several others including non-OPEC Oman are likely to wait until the next OPEC committee meeting before making a decision. Russia, for its part, has yet to commit to the idea, preferring to wait on its own assessment.

US shale growth

Meanwhile, US production continues its remarkable shale-led resurgence, catalyzed by higher oil prices and efficiency gains. Crude output was back up to 9.1 mb/d by the end of March, a gain of 4.3 percent in 2017. Since its nadir in July 2016 at 8.4 mb/d, production is up by 700,000 b/d, or 8.5 percent. Indeed, in the span of 8 months, the US has managed to claw back around 60 percent of the 1.2 mb/d of 'lost' peak-to-trough production.

Shale's remarkable resurgence is proving especially awkward for OPEC and its efforts to manage global supply. The group is well aware that firmer oil prices, thanks to supply cuts, are an incentive for further US shale gains which ultimately undermines oil prices. It is a new reality that oil producers, traditional and unconventional alike, must come to terms with.