.

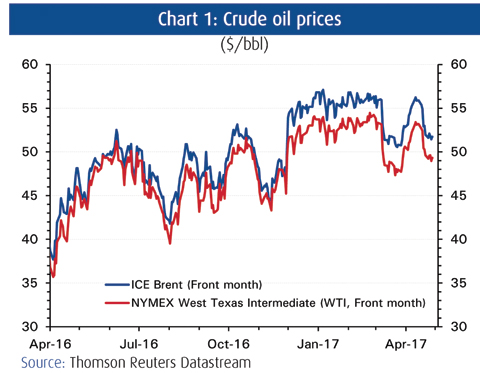

.KUWAIT: Persistent concerns about OPEC's ability to bring down historically high global crude stocks in the face of rising US crude production continued to negatively affect market sentiment in April. Oil prices endured another month of pressure, closing the month down by more than 2 percent to $51.73 per barrel (bbl) and $49.33/bbl, in the case of Brent and WTI, respectively. Prices are down by almost 9 percent on average so far this year as the unwinding of the crude stock overhang appears to be taking longer than many, including OPEC itself, had anticipated.

For its part, the 13-member oil exporters group has stuck to its task of cutting supply as per the 29 November agreement remarkably well; those members subject to reduced production quotas registered an aggregate compliance rate of 102 percent in March (OPEC secondary source data). Total group output fell by 160,000 barrels per day (b/d) to 31.93 mb/d in March, less than 200,000 b/d off the target of 31.75 mb/d. Of the big oil producers, only Iraq and the UAE have yet to comply fully with their new quotas, achieving 76 percent and 85 percent of their targets, respectively. Therefore, OPEC's 100 percent-plus compliance rate is really by dint of overachievement on the part of others, mainly Saudi Arabia; the kingdom has cut its output by 13 percent over and above its current obligation.

This fact has not been lost on Saudi Arabia, which turned on the oil taps last month partly to signal to the OPEC laggards and non-OPEC countries that had yet to fully comply with their quotas, such as Russia, that it was not prepared to bear the burden of production cuts all by itself.

Stubbornly high inventories

Naturally, in view of the slower-than-expected pace of global crude stock drawdowns, talk of extending the output cuts beyond June, when the 6-month agreement is due to expire, has gathered momentum. OECD commercial crude and petroleum inventories, a proxy for global crude and products stocks were, at 3.05 billion barrels in February, still more than 300 million barrels above OPEC's target 5-year average level.

According to the International Energy Agency (IEA), which compiles the data, OECD commercial inventories fell by 9.2 million barrels in February. This would have heartened the markets (and OPEC) more than it actually did in mid-April were it not for the fact that the drawdown was largely in petroleum products stocks (gasoline and middle distillates such as diesel) rather than crude stocks, and were it not for the fact that it was largely non-US based.

In the US, crude stocks actually increased in February and March, before declining for three consecutive weeks in April. The weekly data came courtesy of the US Energy Information Administration (EIA) rather than the IEA, but the trend was the same: the surplus was shifting from crude stocks into petroleum products stocks.

US oil sector

Indeed, developments in the US oil sector tend to exert an outsized influence on the oil markets. While this is partly a result of the US's newfound status as a swing producer, thanks to the special dynamics of light tight oil (LTO, or shale) production, which has had markets enthralled with oil rig counts, crude stocks and drilling productivity, it is also a reflection of the greater frequency and general reliability of US data reports when compared to those from other sources.

Such information asymmetry has proven to be a significant challenge to OPEC, which has discovered that despite its best efforts to up the bullish rhetoric-with moves and continued references to an extension of the production cuts, for example-prices have largely been at the mercy of bearish signals emanating from the US. There, a doubling of oil rigs since last summer has propelled US crude production higher by a sizable 837,000 b/d, or 10 percent, to 9.27 mb/d.

Global crude stock drawdown

Were OPEC and non-OPEC oil producers to extend their agreement beyond June, as seems likely, then by most estimates the market should tighten significantly and global stocks should decline more rapidly. Indeed, according to the IEA's oil demand and supply figures, the oil market has already entered a state of undersupply. (Chart 7.) Assuming OPEC sustains its current 100 percent-plus compliance rate over the next three months and extends the cuts into the second half of the year, then the 300 million barrel stock draw that the group is aiming for should be reached before the end of 4Q17.

Of course, this also assumes that global crude demand growth does not disappoint on the low side, and that global non-OPEC supply growth doesn't accelerate more quickly than anticipated. In terms of demand, the IEA is forecasting growth to increase from an average of 1.1 mb/d in 1Q17 to 1.4 mb/d in 2H17, while on the supply side, the agency expects non-OPEC supply to rise by 0.8 mb/d on average in 2H17.

Despite the short term price weakness and the market's shaky confidence, market participants remain hopeful that the rebalancing which is quite clearly underway will eventually lead to the desired stock drawdown. Whether that point marks oil's arrival to a new, less volatile and more sustainable equilibrium, however, remains to be seen.

NBK ECONOMIC REPORT