OPEC supply cuts and buoyant global demand underpin price spike

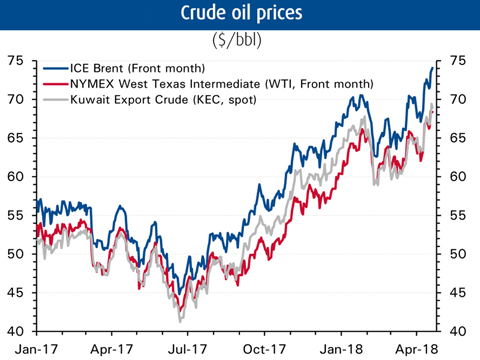

KUWAIT: Despite continued increases in US shale production, oil prices saw sizeable gains last month as market fundamentals continued to tighten and geopolitical factors heightened concerns over supply stability. Brent crude, the international benchmark, has risen 18 percent from its 2018-low in February to more than $74/bbl currently, while West Texas Intermediate (WTI), the US marker, has gained more than 15 percent from its February-low to reach $68/bbl. Both crude markers are trading at close to three-and-a-half-year highs and are up more than 10 percent and 13 percent, respectively, so far in 2018.

KUWAIT: Despite continued increases in US shale production, oil prices saw sizeable gains last month as market fundamentals continued to tighten and geopolitical factors heightened concerns over supply stability. Brent crude, the international benchmark, has risen 18 percent from its 2018-low in February to more than $74/bbl currently, while West Texas Intermediate (WTI), the US marker, has gained more than 15 percent from its February-low to reach $68/bbl. Both crude markers are trading at close to three-and-a-half-year highs and are up more than 10 percent and 13 percent, respectively, so far in 2018.

The US-led airstrike on Syria, concerns over President Trump's intent to withdraw from the Iran nuclear agreement and Venezuela's oil production declines have pushed oil prices up in recent weeks. The prospect of a global trade war sparked by a deterioration in trade relations between the US and China, however, has represented a downside risk. While that fear appears to have eased, the fallout could be significant in terms of reduced global trade, economic activity and therefore oil demand.

Supply concern

President Trump indicated in January that he would not be amenable to continue waiving sanctions on Iran unless the US congress and the other Iran deal signatories (known officially as the Joint Comprehensive Plan of Action, JCPOA) took a tougher line on the Iranian regime's weapons development program. His appointment of Mike Pompeo as Secretary of State and John Bolton as National Security Advisor, two notable foreign policy hawks and vocal critics of the JCPOA, would appear to have made America's withdrawal from the agreement all but inevitable when the deadline expires on 12 May.

Taking the most conservative estimate, 400,000-500,000 b/d of Iran's exports could be lost within a year in the event that sanctions are re-imposed. However, the figure is highly uncertain since the Europeans, the Russians and the Chinese believe that Iran is in compliance with JCPOA obligations and those members purchasing Iranian crude are unlikely to curtail imports unless substantial pressure is brought to bear on them by the Americans (through, for example, restricting access to the US banking system).

Other OPEC members could in theory step in with increased volumes to compensate for the loss of Iranian barrels, but this is unlikely under the current circumstances, with OPEC focused on compliance and determined to keep supplies tight (and prices up).

Venezuela's crude output, meanwhile, continues to decline due to the country's economic crisis and chronic underinvestment. OPEC figures for February show Venezuelan production down to just 1.59 mb/d, a year-on-year (y/y) decline of 700,000 b/d or 31 percent. Its oil infrastructure is creaking under the weight of mismanagement, negative cash flow and foreign obligations-up to 37 percent of the country's oil production (approx. 600,000 b/d) is sent to Russia and China as repayment for past loans.

Absent a reversal in the fortunes of Venezuela or in President Trump's mindset regarding Iran, then markets would likely continue to price in the risk of reduced global oil supplies and decreased global spare production capacity especially in the context of buoyant demand. Oil prices would likely find a new support level around $70, rather than the lower bound of $60 of earlier in the year. The current market consensus is for oil prices to average about $64 this year.

Bullish sentiment

Money managers have amassed a record number of bets on prices going up in recent weeks. The net long position in ICE Brent crude reached 632,444 contracts in mid-April, the highest in data going back to 2011. Though intensifying in recent weeks, this bullish trend began in mid-2017, just after OPEC agreed to extend the supply cuts into 2018. And since then, market fundamentals have tightened, with OPEC withdrawing 1.9 mb/d of crude from the market since January 2017 and reducing OECD crude and product stocks from more than 3 billion barrels at the beginning of 2017 to 2.84 billion barrels in February.

Indeed, the International Energy Agency (IEA) said in its latest report that OPEC and its partners led by Russia could declare as soon as next month "mission accomplished" in their quest to bring global stocks to below their target five-year average. Inventories were only 30 million barrels above OEPC's target as of February, the most recent data point. OPEC and Russia indicated last week that they intend to continue cooperating beyond 2018 in order to keep the market balanced.

OPEC own output fell to 31.9 mb/d in March, according to OPEC secondary sources. Venezuela, Saudi Arabia and Angola led the declines, which totaled 170,000 b/d month-on-month (m/m). This brought OPEC's compliance rate up to a record 163 percent in March, while non-OPEC producers achieved a compliance of 90 percent, the IEA noted.

The IEA puts global demand growth at 1.5 mb/d in 2018, a slight fall from last year's 1.6 mb/d, but still solid. The agency's oil outlook tends to reflect the IMF's economic projections. These now show global growth steady at 3.9 percent in both 2018 and 2019, with emerging Asian economies, led by India, the main engines of global growth. Meanwhile, China recorded another robust quarter of economic growth in 1Q18, with output rising by 6.8 percent y/y. The pace of China's economic expansion is a key barometer of oil demand, given that it is the world's largest oil importer and accounts for 13 percent of worldwide oil consumption.

US shale and trade war risks

The IEA expects non-OPEC supply growth, led by US shale, to top 1.8 mb/d in 2018. US crude production is projected to rise by 1.3 mb/d, almost double last year's growth. Output reached 10.54 mb/d in the second week of April amid rising oil rig counts.

In terms of oil balances, US shale has already replaced more than two-thirds of the supplies withdrawn from the market by OPEC and its partners since the start of last year. But thanks to buoyant oil demand and increasing talk of pipeline bottlenecks in the country, US supply growth will probably not be enough to tip the global oil balance in 2018 from an expected slight deficit (-0.4 mb/d on average) to a surplus. Of course, the market would be affected were global oil demand to take a hit from trade wars sparked by escalating tit-for-tat tariffs between the US and China. The IEA warned that a 5 percent drop in global trade could reduce international fuel oil bunker demand (3.6 percent of global oil demand) by 5 percent, for example.

NBK ECONOMIC REPORT