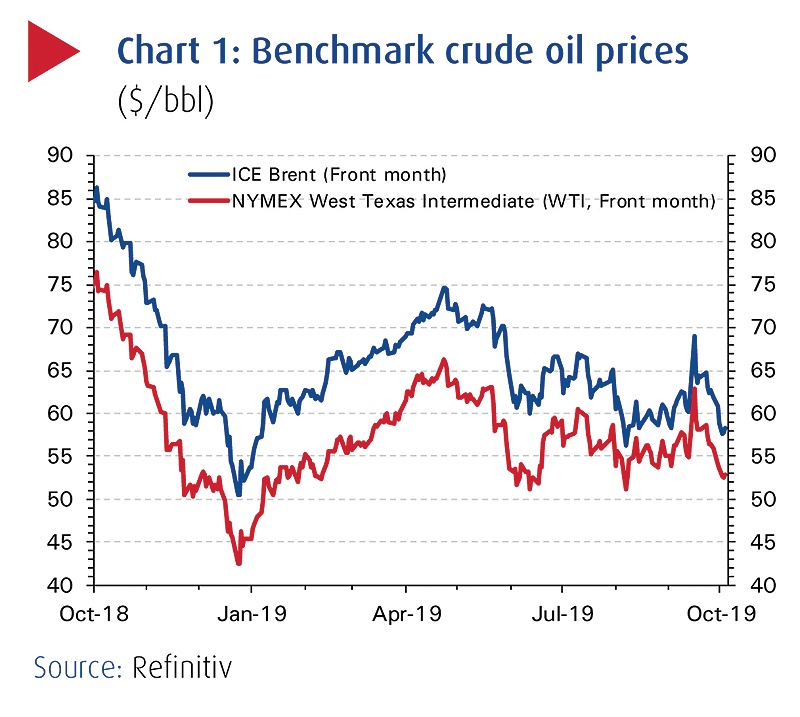

KUWAIT: September closed with oil prices trading at or below where they were on the eve of the missile strike on Saudi Arabia's oil infrastructure. International crude benchmarks Brent and West Texas Intermediate (WTI) ended the month at $60.78 (+0.68 percent mtd; +13 percent ytd) and $54.1/bbl (-1.9 percent mtd; +19.1 percent ytd), respectively. Having given up all their gains accrued in the aftermath of the attack on Saudi's Abqaiq/Khurais oil processing center, both oil markers have since fallen further, with Brent breaching the $60 barrier to close at $58.4.bbl by the end of the first week of October. This was the marker's lowest level since August.

Once again, concerns about the health of the global economy-and by implication oil demand-have come to the fore, fueling the bearish sentiment. The latest setback for oil was triggered by weaker-than-expected US manufacturing and employment data. This, allied to the news that the US had opened another front in its trade war, by slapping tariffs on European exports, to go along with those measures already imposed on China, has only reinforced the narrative of a weakening global economy.

Geopolitics strikes back, briefly

The 14 September drone attacks on Saudi Arabia's Abqaiq oil and gas processing facility and Khurais oil field knocked out 5.7 mb/d of Saudi crude production, close to half of the kingdom's production capacity, and 5 percent of global oil supplies. The international community has blamed Iran for the attacks, even though the Houthis claimed responsibility. When the oil markets reopened, Brent spiked by more than 20 percent, from $60.22 to $71.95 in intraday trading before paring back gains to $69 by Monday's close. Geopolitical risk, of minimal concern in the era of burgeoning US shale supplies, was seemingly back with a vengeance, as markets woke up to realization that the infrastructure of one of the world's most important oil suppliers was vulnerable to disruption from foreign forces.

And two-thirds of the world's entire crude production buffer-oil that could be pumped at short notice to offset supply losses elsewhere-was tied up in Saudi Arabia's 2.3 million barrels of spare crude production capacity.

However, supply outage concerns proved relatively fleeting; Brent fell 6.5 percent to $64.6/bbl by the close of the second trading session and fell in eight of the next thirteen sessions. Reasons for the sell-off are various: concerns over the length of the disruption were allayed by Saudi reassurances that production would be up to speed relatively quickly-within two days Abqaiq had recovered 43 percent (2 mb/d) of its production and within three weeks' Saudi output was back up to 9.9 mb/d, according to the Energy Minister; the Saudis moved quickly to reassure export customers that it possessed sufficient crude stocks (188 mb, equivalent to 28 days of export cover) with which to honor contract deliveries; various energy agencies and houses weighed in by confirming that global crude supplies in storage provided ample short term cover; and lastly a de-escalation in the rhetoric surrounding the incident by the international community even while the US proceeded to tighten sanctions on Iran.

Demand growth to decelerate

The IEA has left unchanged its oil demand growth forecast for 2019 and 2020 at 1.1 mb/d and 1.3 mb/d, respectively. The first six months of 2019 saw one of the weakest first halves of demand growth (0.5 mb/d) since 2008, amid deteriorating global trade relations. Global commercial crude stocks (OECD stocks) continue to trend higher, increasing for the fourth consecutive month to reach 2,931 mb in July. Stock levels are at their highest in almost two years and 19.7 mb above the 5-year avg, which is one of OPEC's targets.

OPEC+ compliance down

OPEC+ compliance fell to 116.5 percent in August from 142.5 percent in July, with Russia, Saudi Nigeria and Iraq among those producers increasing output. Nevertheless, August was the second month in a row that both OPEC and its non-OPEC partners recorded above 100 percent compliance. The combined output cut was 1.4 mb/d, 200 kb/d more than mandated by the Vienna agreement. For Saudi-led OPEC-11, production increased in August by 225 kb/d to 25.78 mb/d, bringing compliance down to 120.3 percent from 148 percent in July. OPEC compliance in September-when that data is released later this month-should increase due to the impact of the drone attacks on Saudi Arabian production.

Demand side worries

In the markets' risk assessment, geopolitics has been deemphasized in favor of global economic growth concerns. In their reasoning, in a world plainly still awash in oil, the threat posed by weakening global economic and oil demand fundamentals should assume greater importance than the threat to global oil supplies posed by supply outages. The downward movement in oil prices has, therefore, reflected that. While the assessment seems reasonable in view of rising global trade frictions and faltering economic data coming out of Europe and the OECD, geopolitical risks are present. It appears unlikely that geopolitical risk-related oil volatility will subside without some kind of movement on or resolution to the vexed issue of the Iran nuclear agreement.

NBK ECONOMIC REPORT