KUWAIT: Brent crude spot price dropped 23 percent during November-18 as concerns over continued oversupply in the oil market coupled with global economic growth concerns overshadowed output cut announcement by OPEC+. Prices remained volatile during the first half of December-18 but witnessed some improvement initially on the back of a trade truce announced between US and China followed by two consecutive weeks of drop in US crude stocks. The announcement by OPEC+ countries to curb output during 1H-19 helped to support prices, but a general weakness across global financial markets kept oil prices under pressure.

Global markets have remained weak recently led by decline in European and Asian indices that affected asset classes across the board. In Europe, the confusion over Brexit pushed down European stocks, while the situation in France and Italy has exerted additional downward pressure. Also, data released by various government authorities have pointed to a slowdown in global economic growth. Japan reported its worst contraction in 4 years during Q3-18 led by decline in capital spending. In addition, the most recent monthly export figures released by China came in weaker-than-expected highlighting a decline in local and international demand. The Nov-18 retail sales in China grew at its weakest pace since 2003 and industrial output growth was weakest in almost three years. Nevertheless, the trade dispute between US and China took a breather after the two countries agreed to not escalate it any further. China announced its first big import from the US amid easing trade tensions and is reported to be reconsidering its China-only manufacturing push as a part of its long term strategy.

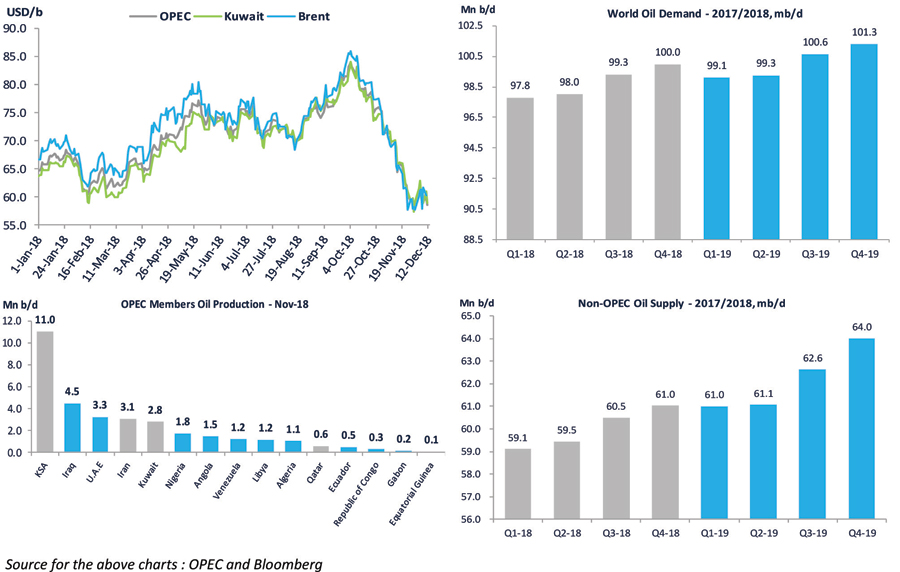

Meanwhile, OPEC+ announced that the group would slash production by 1.2 mb/d during 1H-19. The decision was expected by oil watchers, however, a lack of confidence in global oil demand in 2019 led by rising trade tensions, monetary tightening and geopolitical challenges is said to dent the effects of lower production. In its latest monthly report, OPEC kept overall demand for 2018 and 2019 unchanged but lowered demand for its crude for 2019 by 100 tb/d. The group also said that inventories in developed countries has once again risen back above the five-year average after rising for the fourth consecutive month in October-18 by 5.7 million barrels and stood at 2.87 billion barrels. Monthly production by OPEC remained largely flat m-o-m during November-18 as the increase in production primarily by Saudi Arabia was offset by an almost equivalent decline in production from Iran, according to Bloomberg data.

In its monthly report, the IEA expressed its doubts over whether the announced cuts by OPEC+ would be enough to offset curb the supply glut in the industry. The report said that there could be some surplus next year despite the production cuts. Nevertheless, the IEA said that the decline in oil prices could support oil demand in 2019, although it left its demand outlook for global oil demand growth unchanged at 1.4 mb/d for the year.

Oil prices

Oil prices continued to decline during November-18 and during the first half of December-18, falling from a 4-year high level to the lowest level in 14 months. Both spot Brent and OPEC crudes went below the critical $60/b mark for the first time since October-17 while median estimates for the next four quarters were lowered by an average $2.7/b, according to Bloomberg estimates. Prices saw some recovery at the start of December-18 on the hopes of OPEC+ cuts announcement, however, a slight delay in announcement sent prices southwards. A decline in crude inventories in the US also supported prices in December-18. Average OPEC crude prices dropped 17.7 percent during the month, the biggest decline since February-16. Kuwait crude average price also declined by 17.1 percent to average at $65.2/b while Brent witnessed the biggest drop out of the three crude grades at 20.3 percent to average at $64.7/b.

In its monthly report, the IEA kept its demand growth forecast for 2018 and 2019 unchanged at 1.3 mb/d and 1.4 mb/d, respectively. The report said that the recent rise in oil prices affected non-OECD demand in September-18 and October-18, however, 4Q-18 demand figures were upgraded due to low oil prices. For 2019, the report said that the expected demand decline led by global economic growth slowdown and weak currencies would be offset by low oil prices. In terms of production, the US continued to pump oil eyeing higher oil prices. According to EIA, for the first time in history, US became a net exporter for crude and refined products, which is a key development given the expectations of rising US oil production this year and in 2019. Nevertheless, the latest Baker Hughes rig count data showed a second consecutive drop in oil rig count this week. The total number of active oil rigs in the US stood at 873 after declining by 4 rigs this week and a steep drop of 10 rigs in the previous week. The decline in the previous week was the biggest weekly decline since May-16 and gives an early indication of production decline, albeit marginally, in the near term.

World oil demand

World demand growth estimates for 2018 was kept unchanged from last months' projections and is expected to grow by 1.5 mb/d to reach 98.79 mb/d in 2018. In the OECD Americas region, oil demand in the US continues to remain strong based on monthly data for September-18 and preliminary data for October-18 and November-18.

Oil demand increased by almost 0.52 mb/d y-o-y during the first eleven months of the year backed by higher demand for diesel, jet kerosene, LPG and ethane partially offset by softer demand trend in gasoline, residual fuel oil and naphtha. Oil demand in Mexico witnessed sharp decline in October-18 in line with the first three quarters of the year. On the other hand, Canada reported higher y-o-y oil demand during September-18 with decline in demand for LPG and naphtha were offset by higher demand for jet kerosene, gasoline and diesel. Demand trends in OECD Europe was reported to be mixed during September-18 with lower requirements recorded in Germany and France primarily for diesel while UK, Spain, Poland and a number of other countries recorded higher y-o-y demand. Indications for October-18 shows positive oil demand growth in Germany, France and Italy while the UK recorded flat y-o-y demand. Also, the latest monthly data for vehicle sales in Europe showed a decline of almost 7 percent y-o-y during October-18 denting YTD-18 demand that continues to remain positive at +2 percent. In OECD Asia Pacific, Japan continued to record declining oil requirements in all the main product categories barring gasoline, diesel and residual fuel oil that recorded marginal y-o-y growth in October-18. In the non-OECD group, China recorded strong demand during October-18 with the exception of diesel and fuel oil that recorded a decline due to slower industrial activity. Nevertheless, negative signals were seen in tracking vehicle sales in China that declined by 13.1 percent during October-18. In India, demand for oil products rebounded during October-18 after softer growth in the previous two months. Main product categories recorded strong demand in India, primarily for diesel.

World oil demand growth for 2019 was also kept unchanged from previous projections at 1.29 mb/d and total requirements is expected to reach 100.08 mb/d.

World Oil Supply

Global oil supply increased by 0.5 mb/d m-o-m and 2.95 mb/d y-o-y during November-18 and stood at 100.64 mb/d, according to OPEC monthly report. The increase was primarily led by higher supply from OECD Americas partially offset by a small decline in supply from OPEC producers. On the other hand, IEA estimated November-18 supply at 101.1 mb/d, a m-o-m decline of 360 tb/d due to lower output from North Sea, Canada and Russia. Non-OPEC supply growth projections for 2018 once again saw an upward revision of 0.19 mb/d and is now expected to grow by 2.5 mb/d during the year. Total supply during the year is estimated to reach 60.03 mb/d from non-OPEC countries. The revision mainly reflected upward revisions in historical US and Canada production data as well as increase in supply by almost 0.5 mb/d during Q4-18 mainly from Russia. For the full year, non-OPEC growth in supply would be led by higher flows from US, Canada, Russia, Kazakhstan, the UK and Ghana partially offset by decline in supply primarily from Mexico, Norway and Vietnam. Supply from OECD countries was revised up by 84 tb/d and is expected to grow by 2.29 mb/d to reach 28.0 mb/d during the year. For 2019, supply growth was lowered by 0.08 mb/d to 2.16 mb/d and total supply for the year is expected to reach 62.19 mb/d. The revision primarily reflected a decline in supply from Canada which implemented a mandatory production adjustment along with supply cuts agreed by 10 non-OPEC members of the OPEC+ pact during 1H-19. The y-o-y increase in supply in 2019 is expected to come mainly from the US, Brazil, Russia and the UK partially offset by decline in Mexico and Norway.

OPEC oil production & spare capacity

After increasing by a cumulative 1.3 mb/d over the previous five months, OPEC production remained almost flat during November-18 at 33.1 mb/d, according to crude production data from Bloomberg. OPEC secondary sources estimated the production to be slightly lower at 33.0 mb/d. OPEC's data showed that Saudi Arabia recorded the biggest increase in production during the month adding almost 0.4 mb/d and producing at a record pace of more than 11.0 mb/d. However, the increase was enough to offset an almost equivalent decline in production in Iran.

UAE also recorded higher production during the month that was offset by decline in production from Nigeria and Libya. Production by UAE reached a record high of 3.3 mb/d, according to Bloomberg, surpassing Iran as the third biggest producer in OPEC. The compliance level to production cuts stood at 120 percent during November-18, according to Reuters calculations, compared to 110 percent in October-18. In its latest meeting in Vienna, OPEC agreed to extend the production cuts agreed between the OPEC+ members until 1H-19. The group agreed to lower OPEC+ output by 1.2 mb/d with 0.8 mb/d shared by OPEC producers and the remaining 0.4 mb/d would be reduced by non-OPEC partners. It was also said that the decision would be next reviewed in April-19 instead of June-19 to give ample time for a decision on extension. According to the announcement, there were no quotas assigned to individual producers to lower their output, while Iran, Venezuela and Libya were given exemptions.

Post the output cut announcement, UAE's ADNOC reportedly informed its customers that it would lower January-19 crude allocations by almost 2.5 percent. On the other hand, it was reported that Saudi Arabia plans lower crude exports to the US in January-19 eyeing the excessive build-up in inventories. The Kingdom's average exports to the US stood at 0.86 mb/d during 2018, according to Bloomberg. Meanwhile, production in Libya once again declined during November-18 that continued in December-18 due to severe rainfall that affected oil export terminals in the country. According to reports, the shutdown affected 0.3 mb/d in production since the start of December-18 due to limited loadings in tankers.

KAMCO Oil Market Monthly Report