Kuwait benchmarks perform well in November

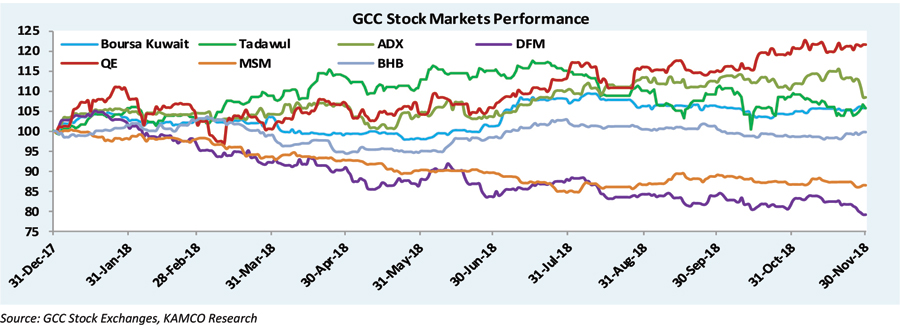

KUWAIT: A steep decline in oil prices during November-18 dampened investor sentiment during the month resulting in mixed performance of GCC markets. Kuwait recorded the best monthly performance followed by Bahrain and Qatar, while Dubai recorded the worst monthly performance declining for the fourth consecutive month which pushed the benchmark's YTD-18 decline to 21 percent. In addition, despite a late month reversal, Saudi Arabia also declined by 2.6 percent, led primarily by weak oil prices. Consequently, the aggregate GCC index declined by close to 1.5 percent during the month, although it remains in the positive territory in terms of YTD-18 returns that stood at 11 percent.

The oil price decline was led by continued oversupply concerns and declining confidence in near term oil demand which resulted in one of the biggest monthly drops for oil prices since 2008. Weak oil prices have also increased the probability of an extension to the oil production cut agreement by the OPEC+ producers. On the other hand, global equity markets were largely positive with the MSCI World Index gaining 2.7 percent during the month led by mid-single digit gains in Emerging Markets and Asian exchanges.

In terms of sector performance, a majority of the industry groups declined during the month. Among the large-cap sectors, decliners included Utilities, Diversified Financials, Transportation and Materials. These declines were partially offset by marginal gains in Telecom and Banking stocks. The Banking sector remained in the positive territory during the month despite a decline in prices of key banking stocks in the UAE. Moreover, the sector continues to boast a YTD-18 return of more than 20 percent, reflecting strong balance sheets and quarterly earnings. In terms of earnings, most of the GCC exchanges reported positive y-o-y aggregate Q3-18 earnings. Growth came on the back of strong banking earnings which grew by double digits in most of the markets.

Kuwait

Kuwaiti benchmarks recorded the best monthly performance during November-18 with all the indices closing the month in the green. Gains were led by large-cap stocks as seen from the 1.6 percent gains for the Premier Market index while Main Market index recorded a gain of 0.8 percent resulting in 1.3 percent gain for the All Share Index. Large-cap stocks have also supported index gains in terms of YTD-18 performance with 10.9 percent gains for the Premier Market Index while the Main Market index declined by 2.0 percent. As a result, the All Share Index had a slightly lower gain of 5.8 percent.

Trading activity remained mixed during the month as a result of higher trades in small-cap stocks. Monthly volume increased by a third to reach 1.9 billion shares during November-18 despite a decline in monthly value traded which dropped by 8.1 percent to reach KD 284.8 million as compared to KD 309.8 million during the previous month. A'ayan Leasing & Investment topped the monthly volume chart with 160 million shares changing hands during the month followed by Gulf Petroleum Investment and Ahli United Bank - Bahrain with volumes of 124.4 million and 115.9 million, respectively. In terms of monthly value traded, KFH topped the list with KD 33.1 million worth of traded shares followed by Gulf Bank and NBK at KD 28.7 million and KD 27.2 million, respectively.

Small cap stocks dominated the monthly performance chart during the month, while prominent large-cap monthly gainers included Kuwait International Bank with a gain of 10.5 percent followed by Human Soft and Viva Kuwait with monthly gains of 9.5 percent and 8.8 percent, respectively.

Monthly gains in these stocks were led by strong y-o-y growth in Q3-18 earnings. On the decliners chart, ACICO and Heavy Engineering Industries & Shipbuilding featured with declines of 12.8 percent and 12.0 percent, respectively, followed by Mezzan Holding at 10.2 percent.

The sector performance chart was almost equally split between gainers and losers although gainers mainly included large-cap sectors. The Telecom index topped the monthly performance chart with a gain of 3.4 percent as the earnings led gains in shares of Viva Kuwait and Zain (+3.6 percent) more than offset decline reported by Ooredoo Kuwait (-3.0 percent) after the telco reported softer earnings. The Real Estate index recorded a gain of 3.0 percent and was second on the monthly list despite a drop in quarterly earnings that almost halved as compared to Q3-17.

Gain for the Banking index stood at 1.7 percent after the decline in shares of CBK (-2.0 percent) were more than offset by gain in rest of the Kuwaiti Banks. Meanwhile, earnings for the Banking sector stood strong with only CBK reporting a y-o-y drop in Q3-18 earnings while aggregate sector reported double digit earnings growth for the period. Aggregate earnings for the exchange remained almost flat with gains in Banks and Telecom earnings offset by decline in earnings for the Industrial, Consumer Services and Real Estate sectors.

Saudi Arabia (Tadawul)

The Saudi market declined for the second consecutive month in November-18 reeling under the influence of the steep decline in oil prices. The benchmark TASI Index dropped 2.6 percent during the month, the biggest monthly decline in 9 months to close at 7,703 points after a late month reversal trend failed to offset declines since the start of the month. The decline during November-18 further lowered YTD-18 gains for the market which stood at 6.6 percent. The sector performance chart also reflected the market weakness with a majority of the sectoral indices closing the month in the red. The Food & Beverage index witnessed the biggest monthly drop of 5.4 percent after quarterly earnings for the sector more than halved during Q3-18 as compared to Q3-17. Among the large-cap sectors, the Materials index dropped 4.7 percent while Telecom and Banks declined by 2.0 percent and 1.8 percent, respectively.

Quarterly earnings performance for the exchange remained flat at SAR 32.8 Bn during Q3-18. However, changes among the sectors varied with higher earnings recorded by Banks, Materials, Real Estate and Telecom offset by decline in profits recorded by Energy, Transportation, Consumer Services, Food & Beverage, Healthcare and Insurance sectors. Banking sector earnings were up by 11 percent y-o-y during Q3-18 after the listed banks in the Kingdom, with the only exception of Saudi Hollandi Bank, posted positive growth and most of them double digit y-o-y increase in Q3-18 earnings. Materials segment also posted a strong y-o-y earnings growth of 10.6 percent during Q3-18, while on the other hand, earnings for the Energy sector more than halved during Q3-18 as compared to Q3-17.

The monthly gainers chart was topped by Anaam Intl. Holding with a gain of 24.9 percent followed by Al-Sorayai Trading and Saudi Fisheries recording gains of 23.2 percent and 23 percent, respectively. Shares of Anaam went up after the company announced signing of MoU to acquire real estate and commercial assets held by the two companies. In addition, both Anaam Intl Holding and Al-Sorayai Trading reported lower losses during Q3-18. On the decliners side, three out of the top five companies were from the Materials sector including Saudi Paper Manufacturing (-16.3 percent), Methanol Chemical Co. (-14.4 percent) and Sahara Petrochemical (-12.8 percent) while Saudi Industrial Export Co. topped the chart with a decline of 26.0 percent. Shares of Saudi Paper Manufacturing declined after the company reported a steep decline in topline as well as higher y-o-y losses during Q3-18. Meanwhile shares of Sahara Petrochemical declined after a manufacturing plant at one of its subsidiary companies underwent an emergency shutdown.

Trading activity witnessed a steep drop during the month in terms of both volume and value of shares traded on the exchange. Monthly volume of shares declined by 30.3 percent to reach 2.7 Bn shares in November-18 as compared to 3.9 billion shares in the previous month. Total value traded on the exchange also dropped at an even higher pace of 35.1 percent to reach SAR 62.2 billion as compared to SAR 95.7 billion during the previous month. Alinma Bank topped the monthly volume chart with 338.7 Mn shares traded during the month followed by Dar Al-Arkan and Saudi Kayan with 200.3 million shares and 139.3 million shares, respectively. In terms of monthly value traded, SABIC topped the chart with SAR 8.1 billion worth of shares changing hands during the month followed by Alinma Bank and Al Rajhi Bank with trades worth SAR 7.1 billion and SAR 3.1 billion, respectively.

Abu Dhabi Securities Exchange

After declining for two months in a row, the ADX index declined in Nov-18 and closed 2.7 percent lower m-o-m at 4770.08 points. Market breadth favored decliners, as 16 stocks gained, while 32 stocks declined. Sectoral performance barring the Services sector was negative. The Energy index was the worst performing index on the ADX, declining by 12.6 percent, driven by double digit declines in crude oil prices, as Dana Gas lost a fifth of its market capitalization, while Abu Dhabi National Energy moved down by 8.9 percent m-o-m. Investment & Financial Services names followed, as the index receded by 9.9 percent m-o-m, driven mainly by a decline in the share price of Waha Capital (-9.7 percent), while Al Khaleej Investment lost 7.9 percent m-o-m. Real Estate index woes in the UAE continued and reflected on stock prices as well, as the index was down 7.8 percent m-o-m and was the worst performing index YTD (-26.8 percent). Within the index, Aldar (-7.5 percent), Eshraq Properties (9.2 percent) and Ras Al Khaimah Properties (-8.3 percent) saw lower levels. For the Services index which gained by 1.2 percent, larger stocks Abu Dhabi Aviation and National Corp for Tourism & Hotels saw higher levels.

In earnings releases, energy company ADNOC Distribution reported 9M-18 net profit of AED 1,682 million an increase of 28 percent y-o-y as compared to 9M-17. EBITDA grew by 33 percent y-o-y in 9M-18 to AED 2,157 million. Fuel volumes sold decreased 2.3 percent y-o-y at 7,179 million liters.

Dana Gas saw its 9M-18 revenues increase 6 percent y-o-y to AED 1,287 million from AED 1,210 million in 9M-17, on higher prices. The company's 9M-18 net profit was AED 149 million as compared to AED 458 million in 9M-17. Excluding one-off items, net profit was AED 149 million in 9M-18, as compared to a net loss of AED 22 million in 9M-17. In KRI, the company completed the debottlenecking project that is targeting a 25 percent boost to output. The company possesses a 10 year gas sales agreement with KRG to supply and sell additional quantities of gas into the local market for power generation.

Separately investment company Waha Capital reported a 10.2 percent rise in net profit to AED 295.1 million in 9M-18, largely driven by the company's Private Investments business. The company's Private Investments business recorded a 16.9 percent y-o-y increase in net profit at AED 309.2 million. The business line was aided by continued robust contribution from its stake in New York-listed AerCap Holdings NV, as well as a gain of AED 64.1 million from the sale of 6.68 million AerCap shares, following their expiration from a collar hedging and financing arrangement.

DFM Monthly Sector Performance

The DFM index declined for the fourth month in a row in Nov-18, and was the worst performing index for the month. The index declined by 4.2 percent m-o-m and closed at 2668.66 points, as the performance of sectoral indices was mostly negative. Consumer Staples was the worst performing index as the sector plunged by 19.5 percent m-o-m in Nov-18, driven mainly by a 21.6 percent decline in the share price of DXB Entertainment. The stock was down over 57 percent YTD and has been under pressure over questions of discretionary spending in Dubai.

Insurance names followed with declines of 15.3 percent m-o-m, as larger names within the index that were traded witnessed declines. Investment & Financial Services also lost ground by 13.6 percent m-o-m and were dragged down by Dubai Investment (-16.7 percent) & DFM stock (-4.3 percent). Real Estate and Construction names continued to remain under pressure, declining by 8.4 percent, as real estate prices and rents continue to move lower. Transportation was the best performing index as the index went up by 3.0 percent m-o-m, driven by Aramex, which gained by 7.8 percent. Telecoms also closed higher by 1.4 percent, as DU witnessed gains of 1.4 percent m-o-m.

In 9M-18 earning releases, Emaar Properties reported revenues of AED 17.390 Bn for 9M-18, up 30 percent y-o-y from AED 13.35 Bn during 9M-17, led by growth achieved by Emaar Development, UAE build-to-sale property business majority owned by Emaar, as well as better performance from Emaar Malls. Emaar Development has a backlog of AED 38.527 billion, led by property sales of AED 10.030 billion for 9M-18.

Qatar Exchange

Qatar was amongst the gainers in the GCC in Nov-18, and continues to lead other regional markets YTD (+21.6 percent). The QE 20 index improved by 0.6 percent m-o-m to close at 10364.54 points in Nov-18. The Qatar All Share index which maps the broader market, closed 1.8 percent higher as compared to the previous month. Market breadth was broadly even as 25 companies receded, while 20 companies moved higher as compared to the previous month. Sectoral performance was mixed and included both gainers and losers. Heavyweight indices such as Real Estate and Banks & Financial Services indices closed in the green during the month. Real Estate was the best performing sectoral index, gaining by 10.4 percent m-o-m, driven by Ezdan Holding and Barwa Real Estate, as the stocks closed 16.4 percent and 2.2 percent higher respectively m-o-m. The Banks & Financial Services index moved higher by 2.0 percent and was driven higher by banks mainly -QNB (+2.3 percent),

Commercial Bank of Qatar (+1.8 percent) and Masraf Al Rayan (+5.5 percent). After being a worst performer in Oct-18, Telecoms rebounded and gained by 9.2 percent m-o-m in Nov-18, led by a jump in Ooredoo's share price (+14.7 percent). On the decliners side, Industrials was down 2.9 percent m-o-m, as Industries Qatar (-3.2 percent), Messaieed Petrochemical (-5.0 percent) and Qatar Electricity & Water (-4.2 percent) lost ground during the month.

In corporate announcements, Qatar National Cement Company announced the production of white cement. The product is available in the form of bags weighing 50 kg at a price of QAR 25 per bag and available in bulk at a price of QAR 500 per ton. Previously the company has announced production of Slag as well to meet the local market demand in accordance with the Qatar Vision 2030. Separately, Qatari German Company for Medical Devices announced the signing of a cooperation agreement in the field of Medical Manufacturing with Al-Jazira Healthcare group for the purpose of manufacturing multiple types of medical supplies used of Qatar in order to meet the needs of the local market and in line with Qatar 2030 vision that aims for achieving self-sufficiency in this sector. In the banking sector, Qatar Islamic Bank launched the first Islamic Point of Sale (POS) & Online Payment Gateway solutions in collaboration with QPAY international.

Bahrain Bourse

The Bahrain Bourse was amongst the best performing GCC indices in Nov-18, closing in the green for the month. The Bahrain All Share Index closed at 1328.81 points and moved up by 1.1 percent m-o-m. Sectoral performance was mixed, but more sectors gained during Nov-18. The Investment index was the best performing index as the sector gained 3.9 percent m-o-m, driven by United Gulf Holding Company as its share price jumped by 29.5 percent m-o-m. Industrials also gained by 1.7 percent m-o-m, driven solely by Aluminum Bahrain, as the bellwether gained by 1.7 percent m-o-m. Gains from Batelco (+4.8 percent) and Bahrain Duty Free Complex (+1.4 percent) also ensured that the Services index moved up by 1.7 percent. Commercial Banks however declined by 0.6 percent m-o-m in Nov-18, as Al-Khaleeji Commercial Bank (-8.9 percent) and Al Salam Bank (-7.1 percent) pulled down the index.

In earnings related releases for 9M-18, GFH reported consolidated revenues of $184.62 million as compared to $163.16 million in 9M-17, representing a growth of 13.2 percent y-o-y, primarily from revenues generated from its investment banking business. The company reported a net profit of $103.44 million for 9M-18 representing a 18.6 percent increase from $87.23 million in 9M-17. The increase was ascribed to continued growth and stronger contributions from the GFH's core investment banking business and other related investment income.

Telecom operator Batelco reported 9M-18 revenues of BHD 301.5 million, an increase of 9 percent y-o-y as compared to BHD 277.6 million. Revenue growth was driven by strong performance at Batelco Bahrain, Umniah in Jordan and Dhiraagu - the Group's operation in Maldives.

Muscat Securities Market

Muscat Securities Market dropped for the second consecutive month during November-18, although marginally to reach 4,412.1 points. The decline came after all the three sectoral indices declined during the month. The Industrial index dropped 1.6 percent followed by Services index at -1.5 percent while the drop in the Financial index was marginal at -0.5 percent. Within the Industrial index, gains recorded by Al Maha Ceramics (+5.1 percent) and Al Anwar Ceramic Tiles (+2.56 percent) were more than offset by declines recorded by Oman Cement (-4.43 percent)and Voltamp Energy (-2.21 percent). Ominvest (-5 percent) was the biggest decliner in the Financial sector followed by Bank Sohar (-3.2 percent) and Al-Sharqia Investment Holding (-3.2 percent). These gains were partially offset mainly by 1 percent gains in Bank Muscat (+1 percent).

KAMCO GCC Markets Monthly Report