click to view larger

click to view largerKuwait Bay, which is 35 km long and 20 km wide, is the biggest nursery for marine living creatures which suffered from the most disastrous catastrophe of fish kills in August and September of 2001 by the death of about 3,000 tons, or about 7 million fish, estimated by "Ragheda Haddad" in collaboration with "Al-Qabas" newspaper. This quantity was adequate to feed Kuwaitis for 5 years. After diagnosis and solution proposals by local research teams, Kuwait pursued assistance from a

Japanese team to repeat the diagnosis causes and train a permanent team to deal with the bay diseases. The diagnosis did not bring anything new to us, ie closure of "Draideer" area which slowed water circulation therein. Two ports that cannot be tolerated by the Bay, water desalination plants, waste water injection to oil wells, human industrial and medical pollutants in addition to unjust drainage are just examples of what is happening.

In other words, Kuwait Bay is a main source of what people eat and drink. 16 years after the 2001 crisis, awareness of danger was supposed to stir the sense of any official, the bay conditions became worse. Signs of pollution consequences began early this year. Fish kills began in

April and not in the hot and moist August which causes severe shortage of oxygen.

This matter could have been easily handled by minimum level of environmental awareness and some artificial cure a long time ago. Ironically, the government issues a statement claiming that the fish kills average in this time of the year is in the normal range due to changing temperatures in addition to human causes relevant to polluting Kuwait Bay. But what we should know is that what the government considers as normal death rate of fish is originally quite high; and the fish stock coupled with its disease drops drastically. This represents a crime against the current generation and the future generations as well.

Kuwait occupies the 81st position in the "Environment Index" issued by "Rotterdam" university for 2014. It also occupied position 42 out of 178 states in the "Environment Performance Index" issued by "Yale" university in 2014; it however lagged to position 113 in 2016. The Council of Ministers statement concurs that the environment regression is normal with some increase in pollutants.

This backwardness is consistent with Kuwait's lack in the indicator of perceptions of corruption, competitiveness and business practice environment. It is unacceptable to have an official statement that declares that this backwardness is still within its former levels and the maximum government's ambition is to maintain those low levels. Doctor "Salam AlAblani" says that Kuwait Bay condition has reached a chronic ailing case as a result of polluting Kuwait Bay by industrial wastes which weaken the immune system of these marine living organisms in the second best nursery worldwide. Thus the impact of natural causes transforms into a catastrophe. He then provided at least three easy but neglected solutions since 2001. This means that what is happening is human made.

When can we believe that Kuwait is much better than what is happening to it? When can we believe that Kuwait with its human and financial resources is capable to be much better than its reality? All the foregoing is the outcome of the incompetence of the public administration.

Crises occur in any country but they occur at distant intervals with learned lessons for not recurring and preventing others from occurring. Nowadays, Kuwait wakes up from a crisis this week only to be surprised by another one tomorrow while the region is not the same, neither are the resources. Premises are much more difficult and their confrontation requires better administrative capabilities than just referring its crises to public prosecution.

Trading features at Boursa Kuwait

Kuwait Clearing Company issued its report titled "Trading Volume According to Nationality and Category" from 01/01/2017 to 30/04/2017 published on Boursa Kuwait official website. The report indicated that individuals are still the largest group, their share started to increase and they captured 53.2 percent of total value of sold shares (48.5 percent for the first third 2016) and 52.9 percent of total value of purchased shares (44.1 percent for the first third 2016). Individual investors sold shares worth KD 1.719 billion and purchased shares worth KD 1.708 billion with a net trading, selling, by KD 10.813 million.

The second largest contributor to market liquidity is the clients' accounts (portfolios) which captured 22.2 percent of total value of sold shares (17.3 percent in the same period of 2016) and 21.4 percent of total value of purchased shares (15.4 percent in the same period of 2016). The sector sold shares worth KD 718.604 million and purchased shares worth KD 690.522 million, thus making its net trading, more selling, by KD 28.083 million.

The third contributor, is the corporations and companies sector which captured 18.9 percent of total value of purchased shares (31.2 percent in the same period of 2016) and 18.1 percent of total value of sold shares (25.1 percent in the same period of 2016). The sector purchased shares worth KD 610.938 million and sold shares worth KD 585.979 million with a net trading, more purchasing, by KD 24.959 million. The last contributor to liquidity is the investment funds sector which captured 6.8 percent of total value of purchased shares (9.22 percent in the same period of 2016) and 6.4 percent of total value of sold shares (9.61 percent in the same period of 2016). This sector purchased shares worth KD 221.241 million and sold shares worth KD 207.304 million, with a net trading, purchasing, by KD 13.937 million.

Boursa Kuwait continues to be a domestic Boursa with the Kuwaiti investors forming the biggest trading group and sold shares worth KD 2.924 billion capturing 90.5 percent of total value of sold shares (86.61 percent in the same period of 2016) and purchased shares worth KD 2.871 billion, capturing 88.9 percent of total value of purchased shares (86.56 percent in the same period of 2016). Thus, their net trading, the only one selling, scored KD 52.764 million, which is an indicator of a receding confidence of local traders.

Other investors' share, out of total value of purchased shares, scored 7.9 percent (9.5 percent in the same period of 2016), and purchased shares worth KD 254.420 million, while their value of sold shares worth KD 210.544 million, 6.5 percent of total value of sold shares (10.3 percent in the same period of 2016). As a result, their net trading, more purchasing, scored KD 43.875 million.

Share of GCC investors, out of total value of purchased shares, formed 3.2 percent (3.9 percent in

the same period of 2016), worth KD 104.946 million, while value of sold shares formed 3 percent (3.2 percent in the same period of 2016), worth KD 96.057 million, their net trading, purchasing, by about KD 8.888 million.

Relative distribution among nationalities changed from its previous one and became as follows: 89.7 percent for Kuwaitis, 7.2 percent for traders from other nationalities, and 3.1 percent for GCC traders vis-à-vis 86.5 percent, 9.9 percent and 3.6 percent for Kuwaitis, other nationalities and GCC traders respectively in the same period of 2016. This means that Boursa Kuwait remained a local one with the rise in the share of its investors from local traders. However, the turnout is still higher

from investors mainly outside the GCC region than from the inside of the GCC region in which an overtrading of individuals is a dominant factor.

Number of active accounts between the end of December 2016 and the end of April 2017 rose by 29.5 percent (compared to a decrease by -7 percent between the end of December 2015 and the end of April 2016). Number of active accounts in the end of April 2017 scored 20,208 accounts, 5.4 percent of total accounts, versus 19,652 accounts in the end of March 2017, 5.2 percent of total accounts for the same month, with a rise of 2.8 percent during April 2017.

Balance of payments 2016

The Central Bank of Kuwait (CBK) published preliminary figures of the balance of payments for 2016, which indicate that the current account recorded a deficit of about KD 1.510 billion, the equivalent of approximately $4.998 billion, (4.5 percent of total estimated 2016 GDP), which is the first since 1993 when the CBK reclassified the components of the balance of payments, ie Kuwait entered the tunnel of double deficit of the general budget and current account. The current account scored a surplus of KD 1.208 billion for 2015. The Central Bank has adjusted 2015 figures, downwards putting the surplus at KD 1.208 billion instead of the KD 1.797 billion, i.e. with adjustment rate of approximately -32.8 percent. The current account consists of balances on goods, services and investment incomes in the two sectors, the public and private and the current transfers for the two sectors. The balance on goods surplus (the difference between values of merchandise exports and merchandise imports) dropped from about KD 8.396 billion to KD 6.075 billion, down by KD -2.321 billion, or by 27.6 percent. Oil exports revenues dropped from KD 14.581 billion, or 89 percent of total merchandise exports in 2015, to about KD 12.527 billion, or 89.1 percent of total merchandise exports in 2016, a decline by 14.1 percent. The value of merchandise imports dropped very slightly by about -0.1 percent to about KD 7.977 billion. Net investment income value in both public and private sectors rose by KD 197 million, or by 5.1 percent, from KD 3.867 billion in 2015 to KD 4.064 billion in 2016.

The Central Bank tables point to a few significant numbers, such as workers' remittances in 2016, which scored about KD 4.566 billion, the equivalent of $15.1 billion, compared to about KD 4.492 billion in 2015. Total paid compensations during the year 2016, scored about KD 135 million, including about KD 49 million paid by the public sector and about KD 86 million paid by the private sector, vis-a-vis about KD 92 million paid compensations in 2015, including about KD 26 million

paid by the public sector and about KD 66 million paid by the private sector in 2015.

Kuwait, presumably, through its public and private sectors, recorded a decrease in its foreign investments to reach KD 1.068 billion, against an increase of KD 2.360 billion in 2015. This includes portfolio investments, i.e. securities by about KD 5.696 billion, and other investments by KD 6.764 billion. Summary tables indicate that the balance of payments had achieved a surplus by about KD 960 million in 2016, compared with a deficit of KD 886 million in 2015. It is expected that oil market weakness impact will continue in 2017 data.

ABK financial results Q1 2017

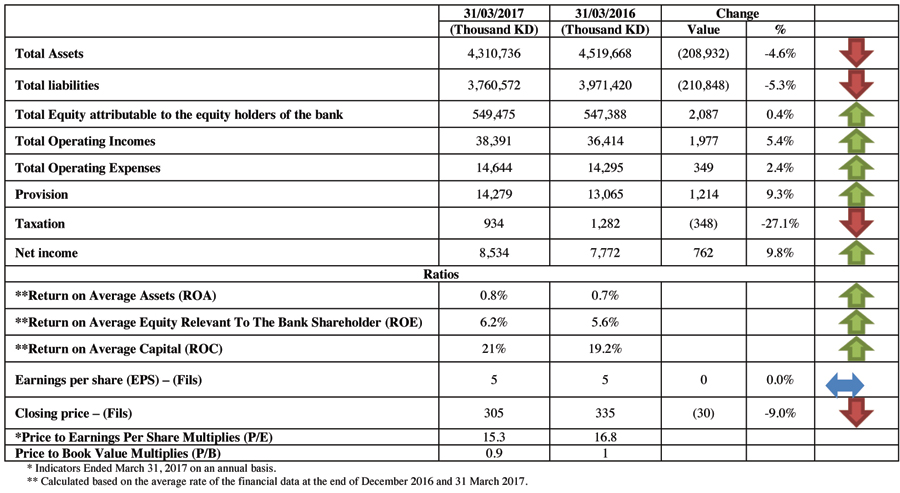

ABK announced results of its operations for the first quarter of the current year, which showed that the bank's net profits, after deducting taxes, scored about KD 8.53 million, up by KD 762 thousand, or by 9.8 percent, compared with KD 7.77 million. This rise in the net profits is mainly due to rise in net operational incomes by a value higher than the rise in total expenditures. Therefore, the bank's operational profits increased by about KD 1.6 million and scored KD 23.7 million compared with KD 22.1 million.

In details, total operational incomes rose by KD 2 million, or by 5.4 percent, to KD 38.4 million compared with KD 36.4 million. While, the item of net interests' incomes declined by KD 507 thousand and scored KD 26.6 million compared with KD 27.1 million in the first quarter of 2016. Likewise, item dividend income dropped by KD 131 thousand and scored KD 956 thousand compared with KD 1.1 million. Total operational expenses increased by less than the rise in operational incomes by KD 349 thousand or by 2.4 percent to KD 14.6 million compared with KD 14.3 million for the same period of 2016. Item of other operational expenses rose by KD 1 million and scored KD 5.7 million versus KD 4.7 million. Other items of operational expenses dropped by KD 657 thousand and scored KD 8.9 million versus KD 9.6 million. Percentage of total operational expenses to total operational income scored 38.1 percent versus 39.3 percent. Total provisions increased by KD 1.2 million, or by 9.3 percent, to KD 14.3 million compared with KD 13.1 million. Therefore, the net profit margin scored 19.6 percent versus 18.2 percent in the same period 2016.

Total bank assets scored KD 4.311 billion, increase by 0.6 percent, versus KD 4.285 billion in the end of 2016. While dropped by 4.6 percent if it is compared with total assets in the first quarter of 2016 when they scored KD 4.520 billion. Item of loans and advances, the largest component of bank assets, increased by KD 22.1 million, or by 0.7 percent, and scored KD 3.052 billion (70.8 percent of total assets) versus KD 3.029 billion (70.7 percent of total assets) in the end of 2016.

But they dropped by KD 41.6 million, or by 1.3 percent, if compared with the same period of 2016, when they scored KD 3.093 billion (68.4 percent of total assets). Percentage of total loans and advances to total deposits scored about 83.3 percent compared with 80.2 percent. Item of investments securities decreased by KD 37.4 million and scored KD 200.5 million (4.7 percent of total assets) vis-à-vis KD 237.9 million (5.6 percent of total assets) in the end of 2016 and dropped by KD 113.9 million, if compared with the same period of 2016, when it scored KD 314.3 million (7 percent of total assets).

Figures indicate that the bank's liabilities (without calculating total equity) increased by KD 31.6 million, or by 0.8 percent, and scored KD 3.761 billion compared with KD 3.729 billion in the end of 2016. While dropped by KD 210.8 million, or by 5.3 percent, compared with their value in the first quarter of 2016. Percentage of total liabilities to total assets scored 87.2 percent versus 87.9 percent.

Analysis of the bank's financial statements calculated on annual basis indicates that all bank profitability indexes increased compared with the same period of 2016.

Average return on equities relevant to the bank shareholders (ROE) rose to 6.2 percent versus 5.6 percent. Likewise, the average return on capital (ROC) also increased to 21.1 percent versus 19.2 percent. The average return on assets (ROA) increased slightly to 0.8 percent versus 0.7 percent. (EPS) remained stable at 5 fils in the two periods. (P/E) scored 15.3 times improved- versus 16.8 times, due to the drop in the share's market price by 9 percent versus its price on 31 March 2016.

Weekly performance of Boursa Kuwait The performance of Boursa Kuwait for last week was mixed compared to the previous one, where the traded value index, traded volume index and the number of transactions index, showed an increase, while the general index showed a decrease. AlShall Index (value weighted) closed at 376.9 points at the closing of last Thursday, showing a decrease of about 1.8 points or about 0.5 percent compared with its level last week, but it increased by 13.9 points or about 3.8 percent compared with the end of 2011

Al-SHALL WEEKLY ECONOMIC REPORT