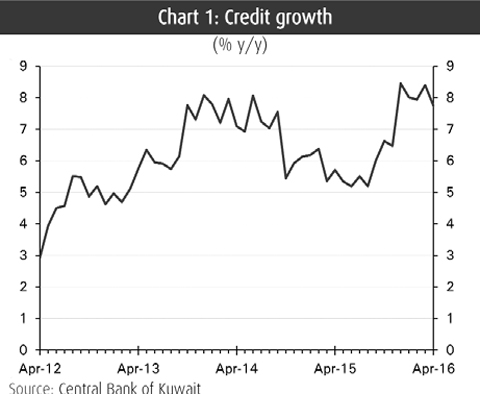

KUWAIT: Private sector credit declined in April, though growth maintained a healthy pace. Total credit was down by KD 156 million during the month as growth slowed to 7.7 percent year-on-year (y/y). The decline was dominated by a drop in credit for securities purchases, but other sectors were also off. Meanwhile, private deposits saw a large decrease on the heels of two consecutive months of large gains, though this was more than offset by a sizeable increase in government deposits. Household debt growth was weaker than usual but continued to register double-digit growth from a year ago.

Installment and consumer loans rose by KD 44 million, with growth slowing to 11.5 percent y/y. Installment loan growth, which continued to dominate, moderated to 13.5 percent y/y. Consumer loans (car, etc.) declined on the month and registered a 1.4 percent y/y contraction. Nonbank financial companies returned to seeing net decreases in credit in April, after two months of gains. Despite the KD 31 million drop, the sector appeared to be close to ending more than five years of deleveraging, with indebtedness declining by a mere 0.4 percent y/y.

The largest declines were in all remaining components of credit. This was off by KD 170 million, with growth slowing to 6.4 percent y/y. A large part of the April weakness was in lending for the purchase of securities which declined by KD 171 million. Still, credit to business sectors excluding securities lending was flat during the month, with growth retreating to 5.1 percent y/y. Industry, construction, and oil & gas all saw declines. The few business sectors to see gains were the real estate sector and trade. Private sector deposits were down in April, though this follows two months of strong gains. Private deposits dropped by KD 361 million, with money supply (M2) growth slipping to 2.0 percent y/y; narrower money supply (M1) growth edged up to 0.8 percent y/y. Declines in private deposits were across the board, with KD time, KD sight and foreign currency deposits all seeing declines during the month.

Government deposits

A relatively large rise in government deposits more than offset the drop in private deposits. The KD 436 million increase was the largest since August 2011 and pushed growth up to 24 percent y/y. Over the last twelve months, government deposits have helped shore-up weakness in private deposits, rising by KD 1.2 billion, while private deposits were up by KD 0.7 billion. Banking system liquidity saw a slight decline in April but maintained a healthy level following two months of strong gains.

Bank reserves (i.e. cash, deposits with the CBK and CBK bonds) declined by KD 179 million to KD 6.1 billion or 10.3 percent of total bank assets (Chart 4). CBK foreign reserves were mostly steady, rising by a small KD 32 million to KD 9.3 billion or 11.6 months of imports. Interest rates declined in April as domestic liquidity conditions improved.

The 3-month Kuwait interbank offered rate (Kibor) dropped 10 basis points (bps) to 1.61 percent in April. Rates continued to ease in May and June, but have since been relatively steady. The 3-month Kibor stood at 1.56 percent in early August. Customer deposit rates also appeared to ease, though moves were more limited. While the average rate paid on a 3-month time deposit was unchanged, the 1-week rate was down by a small 1.4 bps.