Economic growth to benefit from higher gas output

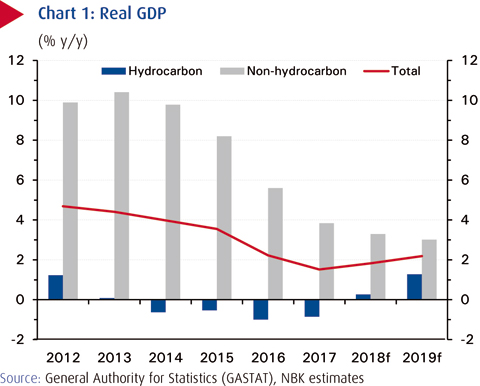

KUWAIT: Qatar's economic growth is expected to edge up slightly in 2018 to 1.7 percent y/y, following last year's growth of 1.5 percent y/y, before accelerating to 2.2 percent y/y in 2019. Economic activity will benefit from output gains in both the hydrocarbon (+0.3 percent y/y) and non-hydrocarbon sectors (+3.3 percent y/y), with the former witnessing an expansion in crude and LNG production and the latter benefitting from the government's $200 billion infrastructure spending program.

Non-oil growth is expected to taper, however, with the government's investment program reaching an advanced phase; only four years remain for many of the high-profile infrastructure projects, such as the metro, light rail system and stadia, to be completed in time for the World Cup in 2022.

The $7.4 billion Hamad Port, which Qatar plans to develop into a regional transport hub and with which the country hopes to bypass trade sanctions, was officially inaugurated at the end of 2017, leaving only a handful of projects left for the authorities to eke out future output gains. Attention, therefore, has turned back to gas/LNG production. In the short term, the delayed 1.4 billion cubic feet per day (bcf/d) Barzan gas facility should finally come on line in 4Q18, supplying additional volumes of gas and condensates, while in the medium term, the authorities' intention to expand liquefaction capacity by 30 percent to 100 million tons per annum (mtpa) will significantly boost growth in the hydrocarbon sector. Amid intensifying competition from Australia and the US, Qatar intends to maintain its position as the world's largest LNG exporter.

Weathering the embargo

Qatar appears to be weathering the trade embargo imposed by Saudi Arabia, the UAE and Bahrain as well as Egypt. It has rerouted passenger and trade flows and stabilized capital outflows that accelerated in the months following the severing of diplomatic ties.

Bank deposit growth, at 3.0 percent y/y in May, appears to be slowly increasing, having benefitted from $30bn in public sector liquidity injections (+75 percent y/y at its height in January 2018) to offset the more than $21bn in private and non-resident deposits that were withdrawn from the banking system. And these have yet to recover to pre-crisis levels, remaining down y/y at -5.3 percent and -24.1 percent in May, respectively.

Private sector credit growth, in contrast, is proving robust. Growth has accelerated every month this year, reaching 10.7 percent y/y in May, led by a broad-based uptick in demand for credit from the consumption, general trade, services and real estate sectors. And this is despite a general rise in the cost of borrowing, although the QCB has only raised its benchmark QMR lending and repo rates once, by 25 bps, to 2.5 percent and 5 percent, respectively, since the beginning of 2017. Interbank rates, are around 2.6 percent.

Inflation slowing

Inflation fell to 0.1 percent y/y in June, weighed down by continued weakness in the real estate sector, with housing and utility costs (22 percent of the CPI basket) declining 4.3 percent y/y in the same month. June's headline rate came down despite the authorities hiking domestic fuel prices in May. The moderation in population growth, a trend which appeared to quicken in the wake of the diplomatic dispute, (+1.4 percent y/y in June), has also been a factor in the slowdown in demand. Inflation is not likely to exceed 0.7 percent in 2018 (avg.).

Fiscal deficit to narrow

Qatar's public finances appear to be on a sounder footing following the government's fiscal consolidation efforts (cuts to subsidies, merging of ministries etc.), which brought public expenditures down by 12 percent in 2017, and the rise in oil and gas prices. The fiscal deficit should continue to narrow to 1.2 percent of GDP by 2019, helped by firmer energy prices and additional non-hydrocarbon revenue streams, such as VAT, which should be implemented next year.

The deficit has been financed primarily by domestic debt, although Qatar returned to the international bond markets in April with a successful $12bn bond sale. Meanwhile, QCB international reserves appear to have recovered to $24.7 billion in May; around $20bn was tapped in 2017 to stem the capital outflows. Public debt is expected to peak at 57.8 percent of GDP this year, before falling to 54.3 percent of GDP in 2019.

The benchmark Qatar Exchange (QE) index has performed well so far in 2018, up by 9.6 percent at 9,341 by 13 July. The market has been buoyed by FTSE inflows and MSCI flows as well as generally positive sentiment linked to higher energy prices and Qatar's ability to withstand the GCC boycott. Indeed, this resilience was recently echoed by Moody's, which changed the outlook on the government's long-term issuer ratings from negative to stable and affirmed its rating at Aa3. Moody's cited Qatar's strong net foreign asset position, its high per capita income and large natural gas reserves as supporting factors.

NBK ECONOMIC REPORT