KUWAIT: The latest data released by the Ministry of Justice -Real Estate Registration and Authentications Department- (after excluding the craft activity and the coastal strip) indicate an increase in the real estate market liquidity in July 2017 vis-a-vis June 2017 liquidity. The total value of contracts and agencies trading scored KD 190.2 million which is higher in value by 7 percent than its counterpart value in June 2017 which was worth KD 177.7 million. It also increased by 26.8 percent compared with July 2016 liquidity. Real Estate trading during this month distributed between KD 163.3 million in contracts and about KD 26.9 million in agencies. Deals scored 430 with 373 deals for contracts and 57 deals for agencies. The highest rate in real estate deals belonged to Mubarak Al-Kabir Governorate and Ahmadi Governorate by 116 deals for each, representing about 27 percent of the total number of real estate deals. Hawally Governorate came second by 58 deals representing about 13.5 percent. The lowest share went to Farwaniyah Governorate by 39 deals representing about 9.1 percent of the total.

KUWAIT: The latest data released by the Ministry of Justice -Real Estate Registration and Authentications Department- (after excluding the craft activity and the coastal strip) indicate an increase in the real estate market liquidity in July 2017 vis-a-vis June 2017 liquidity. The total value of contracts and agencies trading scored KD 190.2 million which is higher in value by 7 percent than its counterpart value in June 2017 which was worth KD 177.7 million. It also increased by 26.8 percent compared with July 2016 liquidity. Real Estate trading during this month distributed between KD 163.3 million in contracts and about KD 26.9 million in agencies. Deals scored 430 with 373 deals for contracts and 57 deals for agencies. The highest rate in real estate deals belonged to Mubarak Al-Kabir Governorate and Ahmadi Governorate by 116 deals for each, representing about 27 percent of the total number of real estate deals. Hawally Governorate came second by 58 deals representing about 13.5 percent. The lowest share went to Farwaniyah Governorate by 39 deals representing about 9.1 percent of the total.

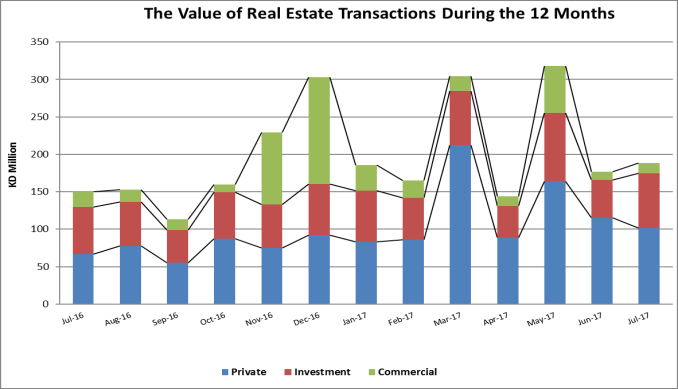

The value of private residential activity scored KD 101.9 million, down by about 11.4 percent compared to KD 115 million in June 2017, representing 53.6 percent of total real estate trading vis-a-vis 64.7 percent in June 2017. The monthly average value for private residence trading in 12 months scored about KD 103.2 million. It means that this month trading value was lower by 1.3 percent than the average. The number of deals for this activity declined to 317 deals in this month versus 366 deals in June 2017. Therefore, the average value per deal of private residence activity scored about KD 321.3 thousand. The investment housing activity increased to about KD 72.8 million, up by 44 percent from KD 50.5 million in June 2017. The contribution to total liquidity increased to about 38.3 percent versus 28.4 percent in June 2017.

The monthly trading average value of investment housing during 12 months scored KD 62 million. It means that trading value in July was higher by 17.5 percent than the 12 months average. Its deals increased to 108 (75 deals in June 2017). Therefore, the per deal average value for investment housing scored KD 673.8 thousand. The commercial activity trading value also increased to about KD 13.7 million, up by 27 percent compared to KD 10.9 million in June 2017. Its percentage out of total real estate trading value increased to 7.2 percent compared with 6.1 percent in June 2017. Average value of commercial activity trading in 12 months scored about KD 38.1 million. It means that total trading in this month is lower by 63.9 percent compared with 12 months' average. It had four deals (similar number of deals in June 2017). As such, the average value per deal for the commercial activity scored about KD 3.4 million. There was only one deal in the warehousing activity for July 2017 with a value of KD 1.8 million. When we compare July 2017 trading with its counterpart period in July 2016, we note an increase in the real estate market liquidity from about KD 150 million to KD 190.2 million, i.e. 26.8 percent. The increase included the private residential activity by 51.9 percent, the investment housing activity by 16.3 percent. However, the commercial activity liquidity decreased by -32.4 percent.

When we compare total trading value since the beginning of the year until July 2017 with its July 2016 counterpart, we note a drop in total real estate market liquidity from KD 1.53 billion to KD 1.49 billion, 2.7 percent. If we assume continued market liquidity level at the same level, the market trading value will score KD 2.55 billion, which is KD 51.4 million higher than the total for last year because trading in the second half of last year was weak. This represents 2.1 percent rise above 2016 level which scored KD 2.5 billion.

Annual CBK report 2016/2017

Generally, goals of monetary policies range between pre-containment of inflationary pressures to keep their risks away from economic competitiveness, by adoption of contracting monetary policy, and stimulation of economic growth by adoption expansionist monetary policies.

The latter has been prevailing since the global financial crisis in 2008 fall. Central banks are responsible for countries' monetary policies. In Kuwait, similar to most oil-export countries, central banks cannot help adopting defensive and preemptive monetary policies to limit the negative impact of uncontrolled financial policies. On May 20, 2007 Kuwait de-pegged its dinar exchange off the US dollar after it concluded that the GCC monetary unity will not materialize. This occurred in 2010. Therefore, the Central Bank of Kuwait gave some flexibility to influence the KD exchange rate movement and even perhaps the interest rates. That flexibility proved its usefulness. The KD lost 9 percent before the US$ since FY 2011/2012 and until last fiscal year. But, most of its exchange rate drop began since FY 2014/2015, or since the oil price deterioration year. The importance of absorbing some impact of reduced revenues comes from indirect compensation of that reduction, ie the rise in the amount of conversion to KD from revenues most of which are in US dollar. Because it is small and gradual reduction, it does not leave great impact on peoples' real income. On the other hand, CBK tries to mitigate the impact of reduced KD exchange rate by preserving the interest rates margin in favor of KD against the US dollar in order to repatriate the KD. According to the CBK's annual report of 2016/2017, that margin increased slightly on short-term deposits for the past FY vis-a-vis the year before. The Central Bank's role in helping the banking sector bypass the repercussions of the global financial crisis is commendable. It acted early on the derivatives crisis of the Gulf Bank. It was also stringent with the allocations policy for the entire sector.

Despite complaints, some of which are excusable, the ultimate results provided very obvious protection to the sector under very difficult financial and geopolitical conditions. Costs of crises could have been quite bigger because few institutions remained beyond the sharp political influence. This means it is important to preserve the Central Bank's independence. Kuwait could have achieved better results had there been coordination and harmony between the financial and monetary policies. But history is decisive in confirming the dominance of the political dose in the course of the financial policy which we hope it will change due to the intolerable conditions.

Financial Stability Report 2016

The Financial Stability Office at the Central Bank of Kuwait issued the Financial Stability Report for 2016 the week before last, the fifth of its type. It presents indexes and details which indicate progress in both quality and in transparency. Thanks to the bank and the concerned department. In this paragraph we shall present very briefly some of this information and indexes which reaffirm the soundness of the local banking sector's conditions in the covered period of the report. Some of its works are still developing and risks are limited. The report emphasizes that banks' assets growth in 2016 was slight at 1.85 percent (2.6 percent in 2015). Loans portfolio, the banks' main activity, grew by 2.9 percent as compared to 8.5 percent in 2015, from which the personal loans registered a growth of 5.8 percent and constituted about 60.2 percent from total assets.

Slow growth in total assets was accompanied by their reduced value to guard against risks. Loans portfolio growth coincided with less defaulting percentage to 2.2 percent which is less than 3.8 percent for 2007 and down from 2.4 percent in 2015. Defaulting coverage scored 237 percent (205 percent in 2015) and 87 percent in 2007 before the world financial crisis. Although traditional and Islamic banks are equal -5 banks for each- traditional banks remained more dominant in owning assets and made 60.7 percent of total assets perhaps due to recent history of incorporating or converted banks to Islamic ones. Shares of traditional and Islamic banks from irregular loans were almost equal, i.e. 59.4 percent for traditional banks or 59 percent contribution to loans portfolio.

Deposits at Kuwaiti banks continued to grow and scored KD 50.4 billion in the end of 2016. These include ownership of deposits of branches or banks owned by local banks abroad. Local deposits formed 78.6 percent thereof, or KD 39.6 billion 63.6 percent of which were termed deposits. This high percentage represents a stability factor for the banks' lending activity. This reinforced status of liquid assets at banks which scored about KD 20.9 billion with basic liquidity forming about 80.1 percent thereof. The growth in assets level and loans portfolio were reflected on the rise in net aggregated profits for Kuwaiti banks' shareholders -traditional and Islamic banks and the Industrial Bank of Kuwait- to KD 745.8 million for the FY ending December 31, 2016 at 5.8 percent growth rate above 2015 level. 62.6 percent of those profits belonged to traditional banks.

Weekly performance of Boursa Kuwait The performance of Boursa Kuwait for last week was more active compared to the previous one, where all indexes showed an increase, the traded value index, the traded volume index, number of transactions index, and general index, AlShall Index (value weighted) closed at 410.5 points at the closing of last Thursday, showing an increase of about 8.3 points or about 2.1 percent compared with its level last week and it increased by 47.5 points or about 13.1 percent compared with the end of 2016.

AL-SHALL WEEKLY ECONOMIC REPORT