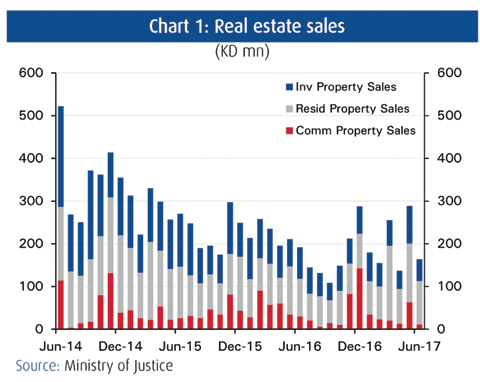

KUWAIT: Increased volatility in real estate activity dominated the first half of 2017 amid steadying prices. Despite some volatility, market activity improved significantly during the first half of the year compared to 2H16, though it remained down 10 percent compared to a year before. Improved activity was particularly visible in the residential sector. This also helped keep real estate prices mostly steady during 1H17.

KUWAIT: Increased volatility in real estate activity dominated the first half of 2017 amid steadying prices. Despite some volatility, market activity improved significantly during the first half of the year compared to 2H16, though it remained down 10 percent compared to a year before. Improved activity was particularly visible in the residential sector. This also helped keep real estate prices mostly steady during 1H17.

Activity in June experienced the usual slowdown from the start of summer and the holy month of Ramadan. June sales eased to KD 163.6 million, down 14.6 percent year-on-year (y/y). The annual decline was mostly due to weakness in the investment and commercial sectors; however, residential sector activity mitigated further weakness with healthy activity despite the seasonal factors. Real estate price indices continue to hover around their six month averages, except for the residential land price index that has retreated somewhat.

The residential sector maintained a solid performance that supported overall activity in June, with revived interest in residential plots. Growing at 15.7 percent y/y, residential sales amounted to KD 102 million in total on 308 transactions. 161 plot sales were recorded during the month, an 85 percent increase from the previous year; most activity was in Abu Ftaira and Al-Salam areas. During 1H17, 757 residential plots were sold compared to 629 plots for the same period last year.

Residential home prices remain steady as residential land prices ease slightly. The NBK residential home price index stood at 151.8 in June, flat for the month once again; the contraction from a year ago was the slowest in thirteen months at 7.7 percent y/y. The NBK residential land index eased to 162.9 in June from 168.0 in May, dragged down by a bulk sale of 49 plots at a relatively lower market price; the pace of decline from a year ago remained steady at 10-12 percent y/y, a pace that was sustained during the last three months.

Investment sector

The investment sector continues to underperform despite the short-lived surge in activity in May. Sector sales totaled KD 50.8 million, down 30.8 percent y/y. The number of transactions was also down by 25 percent y/y to 74. Apartment sales continue to carry the investment sector during the current environment. Single apartments bought for investment represented 61 percent of total transactions.

The NBK investment building price index remained steady in June. The index came in at 190.1 down only 5.6 percent y/y, an improvement from the double-digit decline rates recorded the previous year.

Housing inflation and investment prices align after the recent inflation revision to the CPI. The rise in vacant apartments and the slowdown in market activity have exercised downward pressure on rents that was not visible in the inflation data until recently. The revision of the consumer price index, which showed housing rents down 2.3 percent y/y for June were more in line with real estate prices and activity.

The commercial sector posted the lowest activity since October 2016 with total sales amounting to just KD 10.9 million. Four transactions were recorded in June, the largest being a commercial plot in Qibla for KD 4.95 million.

NBK ECONOMIC REPORT