KUWAIT: Western sanctions crippled Iran's oil sector in the four years leading to 2016, losing around one million barrels per day of oil exports and production. With major sanctions lifted, more Persian crude will be available this year, but the pace and scale at which it will return into the market is unclear. In our view, the increase will be slower than generally expected.

KUWAIT: Western sanctions crippled Iran's oil sector in the four years leading to 2016, losing around one million barrels per day of oil exports and production. With major sanctions lifted, more Persian crude will be available this year, but the pace and scale at which it will return into the market is unclear. In our view, the increase will be slower than generally expected.

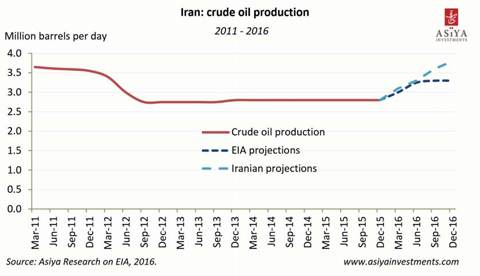

Iranian officials have expressed their intention to increase the nation's crude exports, first by 500,000 barrels per day, and by another 500,000 by year-end. Iran is capable of producing the oil needed to reach those targets. First, around twenty million barrels of crude oil are held in inventory, with half stored in tankers waiting to be shipped, according to EIA and IEA. This is the equivalent of forty days of 500,000 barrels per day. Second, Iran will not be pressured by OPEC due to its current strategy of gaining market share. The likelihood of a joint OPEC decision to cut output is also low due to Iran's rising tensions with Saudi Arabia. Third, the agreement with the West will release frozen Iranian assets, estimated to be worth between $10 and $20 billion annually until 2020. These funds may be used to pay for much-needed investment in the sector. Fourth, Iran has improved conditions for foreign firms planning to invest in the country. The outdated buyback contracting process is replaced by the new Iran Petroleum Contract whereby foreign companies will be able to sign longer term, less risky, deals that would not require the contractor to hand over their oil field work by the end of the project. A conference in London in February will reveal more details as Iranian officials plan to unveil a number of oil and gas projects worth more than $150 billion. Overall, there are reasons to believe the country with the fourth largest proven oil reserves in the world has the ability to raise production to meet its export targets.

However, Iran's plans might not materialize. On the demand side, the Chinese economic slowdown is contributing to the emerging market deceleration. Global oil demand is expected to be weak this year, with IEA and OPEC projecting a deceleration in oil consumption for 2016. On the supply front, Iran will also face difficulties. First, Iran is still subject to a number of restrictions. Conducting US dollar transactions, dealing with the Iranian Revolutionary Guard Corps, which is heavily involved in the energy sector, and using American technology are still prohibited. Second, sanctions have deteriorated Iran's upstream infrastructure, requiring massive investment in the sector. Iranians claim $100 billion of investment is needed to bring oil production back to pre-sanction levels, compared with Western estimates of around $300 billion. Finally, Iran requires the investments of international oil companies to develop its oil exploration and production technology. However, with oil prices at multi-year lows, energy firms' earnings are falling rapidly, forcing them to cut near-term capital expenditure.

IEA projects that, with the help of foreign investment, Iran could reach a production capacity of four million barrels per day by 2020. However, the current environment of low oil prices, geopolitical uncertainty and the outcome of the US elections in November may affect the pace of foreign investment into the country. In spite of the lift of sanctions, the safer bet for Iran is to rely in the Asian powers, which never stopped doing business there: China and India maintained a strong trade partnership with Iran, while Chinese investments in upstream infrastructure in the last several years is expected to generate an additional 200,000 barrels per day by 2017.

By Camille Accad