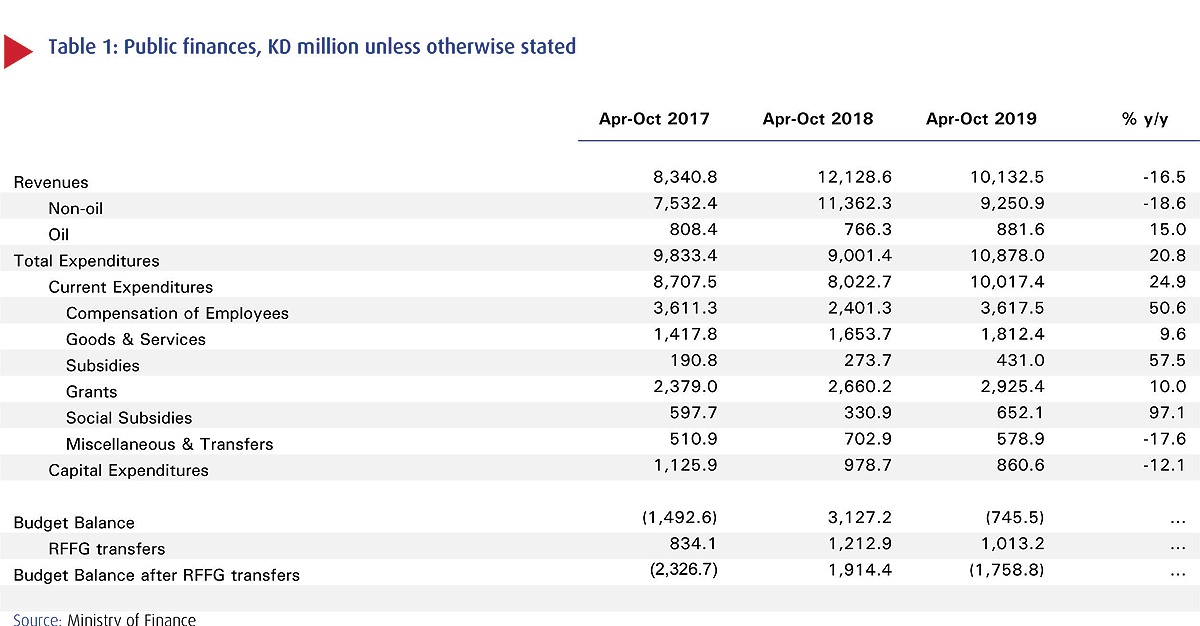

KUWAIT: Preliminary data from the Ministry of Finance shows that the budget registered a deficit of KD 745.5 million during this fiscal year (starting April) up to October. After mandatory transfers to the Reserves for Future Generations fund (RFGF) (10% of total revenues), the deficit stood at KD 1.8 billion, financed mainly through General Reserve Fund (GRF) withdrawals, since no treasury bills and domestic bonds were issued during the fiscal year due to the expiry of the debt law.

The rise in the deficit came amid a decline in Kuwait Export Crude (KEC) prices, frail energy demand, and capped production. Oil revenues declined as well on lower production, suggesting a moderate growth outlook, despite expansionary fiscal policies. Despite the decline in KEC from $71.2/bbl in April to $60.5/bbl in October and the capped oil production at 2,693 tb/d (April- October 2019) due to OPEC+ agreement, total revenues during this fiscal up to October was slightly higher than anticipated, reaching KD10.1 billion, around 64.1% of estimated revenues for the 2019/2020 budget because the budget was based on a lower oil price assumption of $55/bbl.

Nevertheless, compared to the corresponding period of last year, total budgetary oil revenues declined by 18.6% y/y as KEC prices and oil production fell by 8.6% and 1.2% y/y during the period April-October 2019, respectively (Chart 1). Non-oil revenues increased by 15.0% up to October 2019, driven by the rise in taxes and fees as well as other revenues by 15.1% and 13.3%, respectively. However, due to the small size of non-oil revenues (less than 10% of total revenues), government total revenues declined for the first seven months of the fiscal year by 16.5%y/y.

Total spending registered a notable rise of 20.8% y/y for the fiscal year running up until October, boosted by higher than normal increase in current spending. The increase in current spending was driven by three key factors. First, the significant increase in compensation of employees by 50.6% to KD 3.6 billion, which cannot be easily explained but may be related to timing problems.

Second, grants rose by 10% y/y, reflecting the continuous increases in government transfers to government related entities, which depend, to a large extent, on those transfers. Third, purchases of goods and services increased by 9.6% y/y. These recurrent outlays categories account for more than 76% of total expenditure with limited scope to adjust. On the other hand, capital expenditures declined by 12.1% y/y to KD 860.6 million, reflecting softness in project awards and completion delays as several projects have been shifted from the second half of 2019 to early 2020.

The State Audit Bureau in its recent report emphasized the need for fiscal discipline and serious measures to reduce the impact of oil price fluctuations on the budget through diversifying budget revenue sources. In the absence of a debt law, persistent large deficits could lead to the GRF depletion over the next few years. This could have an adverse impact on foreign investors' sentiment and Kuwait credit ratings, although the large resources in the RFGF could still support Kuwait good standing in the long run. Withdrawals from the GRF during the past five years have accelerated with total resources standing at KD 20.6 billion at end-September 2019.

This calls for implementing fiscal measures to reign in budget deficits and preserve what is left of the GRF resources. Diversifying the sources of revenues should stabilize the fiscal stance in the medium and long term, promote sound fiscal management, and reduce the heavy reliance on highly uncertain oil revenues.

NBK Economic Update