KUWAIT: At the recently concluded OPEC+ ministerial meeting, after two days of intense negotiations, Saudi Arabia surprised with its announcement of an additional, unilateral crude production cut of 1 mb/d next month. The move adds to an agreement by OPEC+ to extend existing production cuts of around 3.6 mb/d, including at least 1.2 mb/d of voluntary cuts, beyond 2023 to end-2024. Also notable is the UAE’s securing of a 200 kb/d increase to its reference baseline for 2024 to reflect its increased production capacity.

This was possible only after several OPEC+ members including Angola and Nigeria, acquiesced to an offsetting reduction in their baselines to reflect a decline in their own production capacities. Assuming no change to OPEC+ policy, therefore, as things stand, the only source of incremental supply in 2024 from OPEC+ will come from the UAE. In the run up to the OPEC+ meeting, anticipation had been building that production cuts would be back on the table after prices dropped in May and after Saudi Prince Abdulaziz bemoaned the influence of short sellers on the market, warning them to “watch out”.

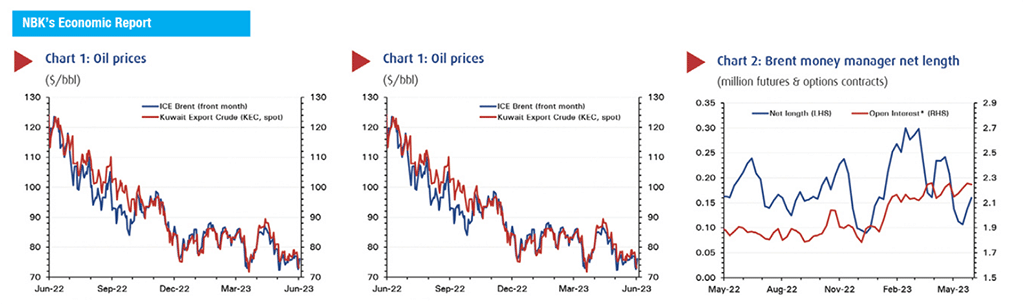

Markets took this as a thinly veiled signal about impending production cuts. May’s oil price drop was the fifth monthly fall in succession as fears of an economic slowdown in the US and EU, exacerbated in recent weeks by concerns over the US debt ceiling, combined with tighter global monetary policy and weaker-than expected Chinese economic data to leave the oil bears in the ascendancy. Resilient Russian oil flows and oil stock-builds in the US fed into the narrative of an oil market that was still fairly well supplied.

By May’s close, international benchmark Brent crude had fallen 8.6%to $72.7/bbl (-15.4% ytd), a shade above the year-low of $72.4/bbl it had set earlier in the month. These are price levels last seen in December 2021. Local marker Kuwait Export Crude (KEC) fell by a similar amount in May to close the month at $74.4 (-8.1% m/m; -9.3% ytd). Reflecting expectations in the run-up to the OPEC+ meeting, money manager net length for Brent crude (the difference between the number of contracts betting on prices rising and those betting on falls) increased to its highest in a month (160k contracts), with three times as many ‘longs’ as ‘shorts’.

This is something of a minor turnaround after net length sank to a five-month low of 106k contracts in mid-May. The global macroeconomic and oil demand landscape remains uncertain. Earlier optimistic expectations of a post-pandemic surge in China’s economic activity, one that would help compensate for lackluster OECD consumption and lift the global economy, have had to be restrained amid a spate of weaker-than-expected economic indicators. OECD commercial oil inventories have also gained during 1Q23 to stand at 4.0 billion barrels by end-March, although the quarterly increase of 35 mb is slight. Nevertheless, the International Energy Agency (IEA) and others continue to view China’s potential this year as positive.

Indeed, China’s growth outlook remains central to the IEA’s repeated, upward revisions to its 2023 oil demand growth estimates: From an annual average of 1.86 mb/d in January to 2.2 mb/d in the most recent, May forecast. The IEA sees the market tightening markedly in 2H23, with oil demand growth averaging 2.5 mb/dy/y and market balances slipping further into deficit (excess of demand over supply) of as much as 2 mb/d in 4Q23. On the supply side, OPEC secondary source data showed total OPEC production trending lower again in April (-188 kb/d m/m) to 28.6 mb/d. Continued disruptions to the Iraqi-Kurdish pipeline to Turkey’s Ceyhan terminal and a workers’ strike in Nigeria offset somewhat surprising output increases in Saudi Arabia (+95 kb/d) and Angola (+79 kb/d). (Chart 5.)

Meanwhile, according to S&P Global, oil production in the 9-member OPEC+ group (excluding Mexico), led by Russia, declined marginally in April to 13.4 mb/d (-10 kb/d). Taken together, the figures show total OPEC+ output (excluding Libya, Iran, Venezuela, and Mexico) falling in April to 37.5mb/d (-246 kb/d), exacerbating the supply shortfall (relative to OPEC+ targets) to 2.6 mb/d. When May’s OPEC+ output data is published later in June, the group’s aggregate production is expected to decline by a further 1.1 mb/d as Saudi, Kuwait and others implement their additional voluntary production cuts. Russian output, meanwhile, was stable at 9.6 mb/d, with only about half of the voluntary production cut of 500 kb/d that the country said it would undertake from March having been implemented.

Indeed, despite sanctions and price caps, Russian oil exports (crude and refined products) have increased to a post-invasion high (8.3 mb/d), the IEA noted, with Russia likely diverting supplies intended for domestic consumption to the overseas market instead in order to boost revenues. China and India especially have shown a voracious appetite for discounted Russian crude, pressuring the market share of traditional West African and even Middle Eastern crude oil suppliers. Kuwait’s crude production in April was steady at 2.68mb/d, according to official sources. Voluntary output cuts of 128 kb/d took effect in May.

With crude oil output lowered due to OPEC+ policy and the country’s newly-commissioned 615 kb/d Al-Zour oil refinery hungry for additional crude supplies as it ramps up refinery throughputs (the third and final crude distillation unit is due by late summer), state oil operator KPC may opt to re-route domestic crude destined for the export market. Kuwait’s refined product exports, which will be increasingly composed of low Sulphur fuel oil and gasoil/diesel, were up at 957 kb/d in February, a fifth consecutive monthly increase.

Kuwait’s refining capacity will stand at 1.4 mb/d, the second largest in the region behind Saudi Arabia. US crude production, meanwhile, has been range-bound this year, seemingly unable to increase beyond 12.3 mb/d (+200 kb/d), in US Energy Information Administration (EIA) data. With shale well productivity gains limited, the persistent decline in US oil rig counts, down 10.6% to 555 so in 2023, would seem to suggest that US output growth may be less than anticipated. It remains to be seen whether Saudi’s unilateral production cut will see oil prices rising above $80/bbl and holding at a new, higher level. Market fundamentals will almost certainly tighten further in 2H23 as a result, causing an acceleration in stock draw downs. Barring a precipitous decline in oil demand due to recession for example, we expect prices to firm in 2H23.