Click to view larger

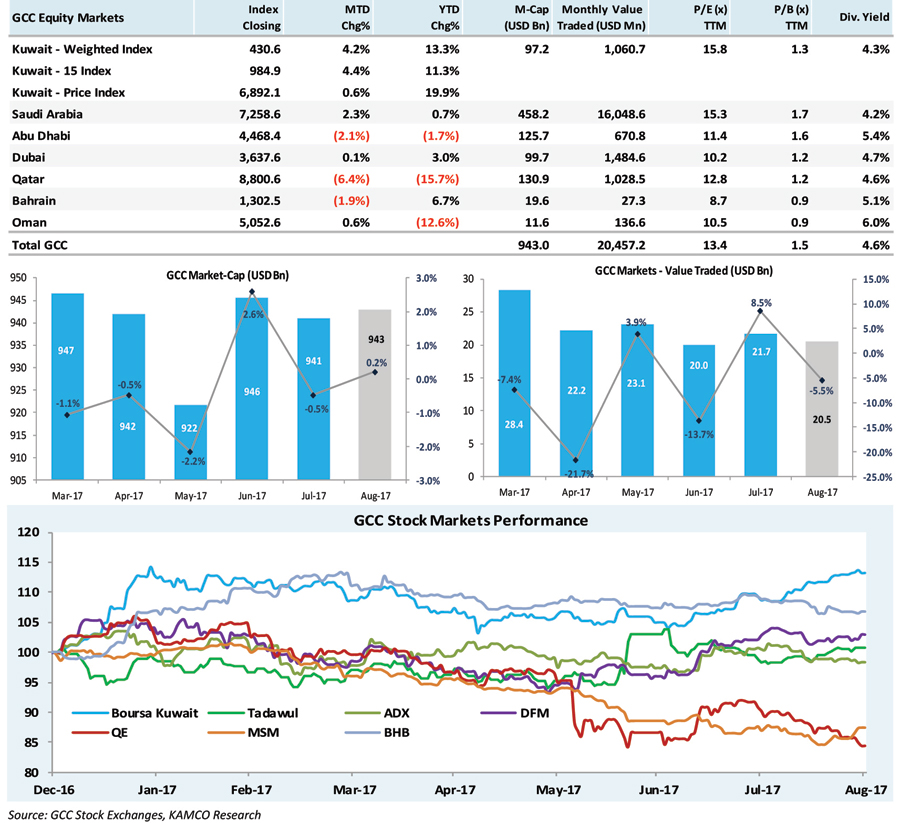

Click to view largerKUWAIT: GCC markets witnessed mixed performance during August-17 due to factors specific to each market along with the normal seasonal profit booking before the Eid holidays. Saudi Arabia and Kuwait witnessed positive returns during the month primarily on the back of expectations of these markets qualifying for the FTSE's secondary emerging markets index in a review later in September. As a result, both the markets witnessed strong trading activity, with investors basically focusing on large-cap blue chip stocks, specifically banking stocks.

On the other hand, Qatar exchange witnessed the steepest monthly drop on the back of the ongoing political deadlock with its neighbors. This also resulted in Fitch downgrading Qatar's sovereign rating by one notch to AA- with a 'Negative' outlook. The agency said that the impact of the deadlock with neighbors could be larger than currently expected.

Meanwhile, global markets were mixed after the bankers meet at Jackson Hole. On one hand, Fed speech lacked signals on the next rate hike or comments on monetary policy that led to a fall in USD after the meeting. On the other hand, ECB head had an optimistic tone on the economic prospects of the region and said that the Euro area was gaining ground even with low inflation rates. The meeting also highlighted a broad based recovery across the globe, but one that is still at its nascent stage.

Oil prices also remained firm during the month with Brent spot witnessing a strong support at $50/b mark on the back of a number of factors including a weak USD, US shale slowdown due to Hurricane Harvey, as well as broader recovery in the commodity market with base metal prices reaching multi-year high during the month.

Kuwait

Kuwait recorded the best monthly performance in the GCC during August-17 on the back of higher trades in large-cap stocks, continuing the trend seen during July-17 based on speculation surrounding the FTSE upgrade. This was reflected in the 4.2 percent gains recorded in the Kuwait Weighted Index and 4.4 percent gains for the Kuwait 15 Index, while the Price index saw marginal gains of 0.6 percent. These gains further pushed YTD-17 returns for Kuwait to nearly 20 percent for the Price Index and 13.3 percent for the Weighted Index, the highest in the GCC. Positive sentiments in Kuwait has prevailed since the start of the Q2-17 earnings season with reported earnings for the quarter up by 14.5 percent for listed Kuwaiti stocks.

Trading activity on the exchange improved during the month with monthly value traded recorded at KD 320.4 million as compared to KD 300.5 million during July-17. Average daily value traded also improved during the month to KD14.6 million as compared to KD13.7 million during the previous month. Monthly volume, however, dropped to 1.7 billion shares as compared to 1.8 billion shares during the previous month, while total trades increased by 4.2 percent to 70,305 trades. In terms of sector performance, large-cap indices surged during the month with Telecom Index gaining 8.9 percent and Banking Index return at 5.6 percent. The Insurance Index, however, topped the monthly performance chart with a strong surge of 21.7 percent as six out of the seven listed insurance names recorded positive returns during the month. Gulf Insurance Group shares were up 49.8 percent, also topping the monthly performance chart. Shares of First Takaful also surged 25.8 percent followed by 9.6 percent for Kuwait Insurance. Meanwhile, the performance of banking stocks was mixed but the index was swayed by 13.7 percent gain in shares of CBK followed by 10.5 percent gains for KFH and 6.3 percent gain in shares of NBK. The positive performance of banking stocks also reflected the healthy earnings for the sector with Q2-17 net profits up by 10.5 percent y-o-y with 8 out of 10 Kuwaiti banks recording positive earnings momentum.

In the telecom sector, shares of Zain and Ooredoo Kuwait witnessed strong gains of 12.4 percent and 4.8 percent, which resulted in overall positive performance for the Telecom index. Gain in shares of Zain came as a result of a deal in which the telecom company sold treasury shares representing 9.84 percent stake in the company to Omantel for $846.1 million. Zain has said to use the proceeds to reduce debt, invest in its network and look for opportunities in the digital space.

In economic news, S&P affirmed Kuwait's AA/A-1+ rating with a 'Stable' outlook. The rating reflects expectation that Kuwait will be able to maintain a GDP growth rate of 3 percent from 2017 to 2020. The rating is supported by high levels of accumulated fiscal, external, and household wealth that helps to offset low oil prices and enable the government to gradually consolidate its finances without weighing on growth.

Saudi Arabia (Tadawul)

After witnessing one of the biggest monthly decline in July-17, Saudi Arabia's TASI was up 2.3 percent during August-17 on the back of strong banking sector performance further supported by stable oil prices that resulted in positive investor sentiments. With these gains, the YTD-17 return also turned positive at 0.7 percent by the end of the month. August-17 also saw the listing of Maather REIT Fund, the fifth REIT to be listed on the exchange. Trading activity on the exchange remained almost flat despite this being a traditionally quite period for the markets. Value traded during the month saw a marginal slide of 0.5 percent to reach SAR 60.2 billion while monthly volume declined by 1.7 percent to

reach 2.9 billion shares. Alinma Bank topped both the volume and value charts with 531 Mn shares worth SAR 8.7 Bn changing hands during the month. Amana Insurance topped the gainers chart and was up 44.6 percent followed by Middle East Specialized Cables at 42.3 percent. The decliners chart mainly included insurance stocks that declined after SAMA banned three insurance companies and four insurance agencies from selling auto insurance policies due to improper practices. Market breadth was skewed towards gainers that included 99 stocks as against decliners that included 74 companies.

Abu Dhabi Exchange

The ADX benchmark once again trended downward during August-17 after posting some improvement during the previous month. The ADX General Index declined by 2.1 percent during the month reflecting a broad-based decline in a majority of the key sectors. The decline in Banking and Real Estate indices were around 2 percent, whereas the Investment & Financial Services and the Services index witnessed steeper declines of 4.6 percent and 8.5 percent, respectively. This market decline was partially offset by positive performance of the Energy, Industrial and Insurance stocks.

A marginal improvement in Q2-17 earnings season also affected market performance during the month. Total earnings for the quarter for ADX listed stocks increased by 1.8 percent to reach AED 10.3 billion ($2.8 billion). However, earnings were softer for the banking sector that reported a decline of 4.3 percent y-o-y.

Dubai Financial Market

Dubai market witnessed stable performance during August-17 with the benchmark index staying relatively flat as compared to the last month resulting in 3 percent index surge for YTD-17. That said, trading activity on the exchange dropped significantly due to seasonal factors. Total monthly volume declined by 28 percent to reach 3.7 billion shares as compared to 5.1 billion shares during the previous month. This was also one of the lowest recorded monthly traded volumes on the exchange. On similar lines, monthly value traded also declined by 26 percent to reach AED 5.4 billion, the lowest monthly value traded since March-13. In terms of individual stocks, Union Properties topped the monthly volume chart with 683.7 million shares traded during the month followed by Gulf Finance House and DSI with 513 million and 344 million shares, respectively. On the monthly value chart, Gulf Finance House topped with AED 945.3 million worth of shares changing hands during the month followed by Emaar Properties and Union Properties at AED 821.9 million and AED 592.1 million, respectively.

Qatar Exchange

The slide in Qatari indices re-emerged during August-17 after showing some improvement during July-17. The Qatar 20 Index recorded the steepest monthly decline in the GCC with a fall of 6.4 percent and once again closed below the 9,000 mark at 8,800.56 points. The broad-based Qatar All Share Index also declined by a slightly higher 6.9 percent indicating the pressure on overall market. The YTD-17 decline was also the highest for Qatar as it reached 15.7 percent for the QE20 Index following months of political deadlock with minimal indications of a resolution in the near term.

The ongoing political situation concerning Qatar has also prompted a sovereign ratings downgrade from Fitch to AA- with a 'Negative' outlook, bringing the country's rating in line with S&P and Moody's ratings that had already undertaken a rating downgrade during June-17 and July-17, respectively. Fitch ratings also highlighted that the country may curtail spending on infrastructure projects in the ongoing sanctions intensify.

Bahrain Bourse

Bahrain Bourse also declined during August-17 following the wider trend in the GCC stock markets highlighting lack of catalyst and profit booking before the holiday season. The benchmark Bahrain All Share Index declined by 1.9 percent during the month as trends has remained weak since the start of the month. The index reached the lowest point in 7 months also breaking a critical support level of 1,300 points to reach 1,298.79 points only to recover on the last day to close at 1,302.46 points. Sector performance also highlighted the weak trends in the market. The Investment sector witnessed the steepest monthly decline of 7.3 percent followed by the Industrial index that declined by 1 percent.

The Commercial Banks index and the Services indices remained flat during the month, while the Insurance index surged 3.4 percent solely on the back of 13 percent gain in shares of Arab Insurance Group.

Muscat Securities Market

After five months of consecutive declines, the Oman's benchmark index witnessed slight improvement during August-17. The MSM 30 index surged 0.6 percent during the month to reach 5,052.6 points after recording consecutive gains during the second half of the month. Pressure on the index was apparent since the start of the month with the benchmark reaching the lowest point in almost 20 months at 4,889.28 points only to recover during the last two weeks of trading. Nevertheless, the marginal index gain during the month, despite the decline in all the sectoral indices, came primarily on the back of strong gains recorded in shares of OmanTel and Bank Muscat, the two largest stocks in the regular market.

KAMCO GCC MARKETS MONTHLY REPORT