NEW YORK: Wall Street stocks fell Wednesday as markets weighed the odds for further equity losses as the end of the "bear market" of 2022 comes into view. After a positive start to the day, US indices slid into the red, adding to losses later in the day amid light holiday-season trading volumes. Analysts also cited end-of-the-year selling by investors who look to record a loss for tax purposes.

"We are in a bear market," said Adam Sarhan of 50 Park Investment. "The good news is the market valuation has gone down significantly over the last six to 12 months and that sets the stage for the next bull market. "However there is still a lot more value compression that can occur before we get to the end of this bear market."

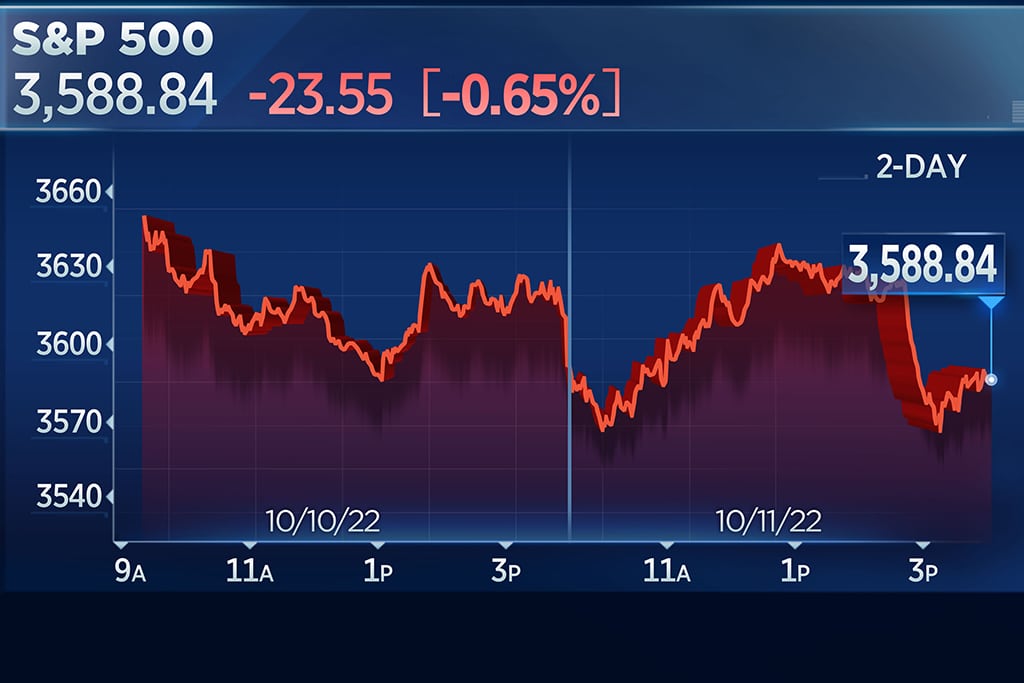

The Dow Jones Industrial Average finished down 1.1 percent at 32,875.71. The broad-based S&P 500 shed 1.2 percent to 3,783,22, while the tech-rich Nasdaq Composite Index dropped 1.4 percent to 10,213.29. Losses were broad-based, but large technology shares suffered more than others. Apple dropped 3.1 percent, Netflix 2.6 percent and Google parent Alphabet 1.7 percent.

Southwest Airlines dropped another 5.2 percent, adding to Tuesday's rout as the US carrier reels from operational problems following a bad winter storm. US-traded Chinese stocks fell amid worries over the spread of Covid-19 in China after it pivoted away from strict safety protocols. Alibaba dropped 3.0 percent while JD.com and Baidu both lost more than four percent.

Stocks sank in Asia and wavered in Europe on Thursday, with sentiment clouded by China's COVID surge. The United States has joined a growing number of countries in imposing restrictions on visitors from China after Beijing announced it would remove curbs on overseas travel as COVID cases surge.

Investors had previously cheered the easing of the nation's strict zero-COVID controls-which had hammered the world's second-largest economy-but are now worried about the impact of the outbreak on global supply chains and inflation. Hong Kong stocks slid 0.8 percent and Tokyo lost 0.9 percent, while Sydney, Singapore, Shanghai, Taipei and Seoul also languished in the red. Europe lapsed into negative territory at the open, before diverging as the morning progressed.

'COVID spike'

"The COVID spike (in China) looks to be impacting sentiment in markets, especially with other countries now taking action due to the scale of the surge," Craig Erlam, analyst at trading platform OANDA, told AFP. "There is a risk ... that the relaxation of curbs will cause some disruption and have knock-on effects elsewhere." Yet volumes were thin in the final trading week of the year, with investors chewing on the prospects of a recession in 2023, and how central banks-especially the US Federal Reserve-are going to handle the fight against rampaging inflation.

"More broadly, equity markets are just drifting into the New Year and will continue to be choppy for the rest of the week in what I expect will be very thin trade," Erlam added. The Fed and others have repeatedly raised interest rates to put the brakes on soaring prices this year, but higher borrowing costs also slow down economic activity.

Oil prices drop

Wall Street tanked Wednesday, with the Dow losing 1.1 percent and the tech-rich Nasdaq sliding 1.4 percent, extinguishing hope of a prolonged festive rally. World oil prices fell sharply on Thursday, with traders concerned that the new China outbreak could fuel a global resurgence of the pandemic and ravage energy demand once again. In Europe, Germany shrugged off Russia's ban on oil sales to countries and companies that comply with a price cap on its crude exports.

The price ceiling of $60 per barrel agreed by the European Union, G7 and Australia came into force this month in response to the Russian invasion of Ukraine. It seeks to restrict Russia's revenue while making sure it keeps supplying the global market. - AFP