Real estate sales drop 15% y/y in August

KUWAIT: Domestic economic news was mixed through September. Non-oil growth came in stronger than expected in 1H18, while elevated oil production and oil prices at four-year highs implied a major boost for the fiscal position. However, consumer spending growth slowed and real estate sales were weak (albeit affected by seasonal factors) - both are traditional pillars of the non-oil economy. In order to support the growth outlook, the Central Bank of Kuwait held off on raising its key lending rate following the latest hike by the US Federal Reserve. There was also a milestone for local capital markets with Kuwaiti stocks upgraded to Emerging Market status by FTSE, triggering sharply higher trading activity and record foreign buying, but making little impact on equity prices amid profit-taking.

KUWAIT: Domestic economic news was mixed through September. Non-oil growth came in stronger than expected in 1H18, while elevated oil production and oil prices at four-year highs implied a major boost for the fiscal position. However, consumer spending growth slowed and real estate sales were weak (albeit affected by seasonal factors) - both are traditional pillars of the non-oil economy. In order to support the growth outlook, the Central Bank of Kuwait held off on raising its key lending rate following the latest hike by the US Federal Reserve. There was also a milestone for local capital markets with Kuwaiti stocks upgraded to Emerging Market status by FTSE, triggering sharply higher trading activity and record foreign buying, but making little impact on equity prices amid profit-taking.

Non-oil growth strong

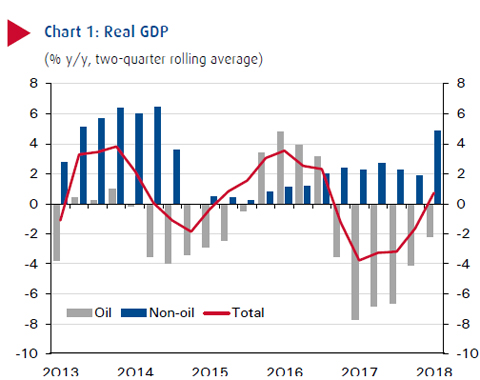

According to preliminary official data, real GDP expanded by 0.7 percent y/y in the 1H2018, improving on its Q1 performance on the back of pick-up in non-oil activity, which offset lower oil-related output. Non-oil GDP was up 4.9 percent y/y in the first half of the year, driven by healthy performances from the telecom, manufacturing, and utilities sectors. Meanwhile, a dip in refining activities (part of the oil sector) led to a decline in oil output by 2.2 percent in 1H18, while crude oil and gas output remained relatively flat in adherence to the OPEC imposed limit; the latter has since been relaxed in an effort to substitute lost supply from Iran and Venezuela.

Although the 1H18 non-oil data is stronger than we had expected, the numbers can be volatile and we continue to project an expansion of 2.8 percent in non-oil activity and of 2.5 percent in oil output in 2018 overall, generating an increase in total GDP of 2.6 percent.

After rallying in August, crude oil prices saw another big rise in September, with Kuwait Export Crude ending the month up 6 percent at $80/bbl and then reaching $83 in early October. There are continued concerns over the supply outlook ahead of the re-imposition of US energy sanctions on Iran in November. Indeed there is some market skepticism about the ability of key members of the OPEC+ group including Saudi Arabia to increase their own output to compensate for Iranian losses, despite assertions to the contrary, with production in August having risen by less half of the 1 million b/d targeted back in June. This has fed speculation that output may already be running into capacity constraints, adding support to prices. With the price of KEC having averaged $70/bbl year-to-date, the risks to our year average forecast of $69 are clearly to the upside.

Oil production

Kuwait has done its part to boost OPEC supplies by lifting its own crude production to 2.80 million b/d in August, up fractionally from July but a more substantial 100,000 b/d (3.7 percent) since May. Our projection remains that output could reach 2.85 million b/d over coming months and for the year overall this would translate into growth of around 2.5 percent. Next year, we project output to be more or less flat at those levels, but Kuwait's production capabilities could rise if, as has recently been reported, output from the Neutral Zone shared with Saudi Arabia is restarted, with Kuwait's share up to 250,000 b/d once fully restored.

Real estate sales

Real estate sales in August stood at KD 132 million, down 15 percent y/y, the lowest value recorded since September 2016. Soft sales were the result of a sharp month-on-month drop in both transaction numbers and average transaction size across all three sectors - residential, investment and commercial. The decline may have been due to a combination of factors, the clearest being that August is typically a slow summer month, but also compounded by the week-long Eid Al-Adha holiday as well as a likely correction after very high sales in July. As for prices, August saw a continuation of the negative trend observed in prior months. The exception was apartment prices, which increased 8.1 percent y/y after declining for most of the year. However, this was mainly due to a base effect following a dip in apartment prices a year prior, and the market remains burdened with declining rents and oversupply.

Consumer spending

The NBK consumer spending index held relatively steady in September, but growth eased for a third consecutive month to 2.4 percent y/y. Weaker spending on non-durables weighed on overall expenditures, but there was a healthy bump in spending on autos and services. Soft wage growth, easing household borrowing and a decline in the number of expatriate dependents may be affecting spending growth. Nonetheless, with confidence at four-year highs, jobs growth improving and higher oil prices supporting the outlook, we expect consumer spending to recover and remain supportive of the broader economic climate over the coming months.

Inflation rose slightly to 0.9 percent in August from 0.8 percent in July, driven mainly by an easing pace of deflation in the clothing and footwear segment and a moderate rise in food prices. These two components together constitute 25 percent of the CPI basket. Food prices rose 1.4 percent y/y having been negative earlier in the year, while the slower pace of decline in clothing prices is likely due to the winding down of summer sales and promotions. Housing rent inflation remained steady at -0.9 percent y/y, while inflation excluding food and housing was also unchanged at 1.9 percent y/y.

Inflation overall seems to be on track to achieve our forecast of 0.8 percent, on average, in 2018. However, some modest downside risk remains including from a soft housing sector, as apartment vacancies remain relatively high and rents continue to decline.

CA surplus hits four-year high

Kuwait's current account registered a surplus of KD 4.7 billion (23 percent of GDP) in the first half of 2018, its best performance in four years, thanks to higher energy prices (the average price of Kuwait Export Crude was up 36 percent y/y in 1H18), which boosted the value of both crude and petrochemical exports. Imported goods were up 8 percent y/y over the same period, helped by increased domestic demand and high levels of consumer confidence. On the services end, travel-related outflows dominated the bill, as usual, and recorded their strongest six-month gain on record.

Stock market buoyant

The Boursa Kuwait All Share index ended September at 5128 points, slightly down (-0.2 percent) from August, but still marginally outperforming the MSCI GCC index (-0.5 percent m/m). This was despite the relatively strong trading value of KD 557 million observed during the month, much higher than the monthly average observed year-to-date. The leading sector in September was the basic materials sector, which saw a rise of 3.8 percent from August, followed by insurance and banking which rose 2.2 percent and 1.8 percent m/m respectively. The worst performers were the real estate and consumer services sectors, which fell by 9.7 percent and 6.5 percent m/m respectively.

Strong activity levels were supported by a record level of foreign investment, at a net value of KD 59 million, which took aggregate foreign investment this year to KD 160 million (+60 percent m/m). These inflows were related to the FTSE's inclusion of Boursa Kuwait in its Emerging Market index, with the first tranche taking place on September 24th and the second due late December. Although net foreign investment was positive, a higher than average value of foreign selling took place in September, while local and GCC investors continued to be net sellers. Additional risk remains in the form of the broader sell-off in emerging markets, though the impact on the Gulf region so far appears modest.

However, overall sentiment remains positive with oil prices rising and an improving macroeconomic backdrop, as well as the possible decision by MSCI to reclassify the Kuwaiti market from frontier to emerging market status in the second half of 2019. If it materializes, the MSCI upgrade could eventually generate about $1.2 billion (KD 364 million) in passive inflows. Further, market performance in general remains fairly strong, with the All Share index up by 6.2 percent year-to-date and market capitalization remaining steady at just under KD 30 billion.

NBK ECONOMIC REPORT