S& P GCC Composite index adds 4.82% for month

KUWAIT: Supported by a strong recovery in oil prices, GCC markets posted a very solid overall performance in April. The S&P GCC Composite index added 4.82 percent for the month resulting in a return of 14.85 percent so far this year. The index performance reflected a robust month for both Saudi Arabia and Dubai. The Tadawul All Share Index was the leader in the GCC in terms of performance adding 5.5 percent in April and bringing its 2019 return to 18.9 percent.

The DFM General Index came in second with an advance of 5.02 percent after ending March practically flat. Qatar Exchange Index followed and was up 2.67 percent, thus returning marginally to positive territory for the year at 0.76 percent. Bahrain closed the month up 1.46 percent followed by Kuwait which advanced marginally by 0.22 percent as profit taking dominated after the solid performance during the previous month. The broader A&P Pan Arab Index underperformed the GCC as it advanced by 4.12 percent in April, mainly caused by an underperformance in the EGX30 which advanced by 1.24 percent and a decline in Jordan of 6.12 percent.

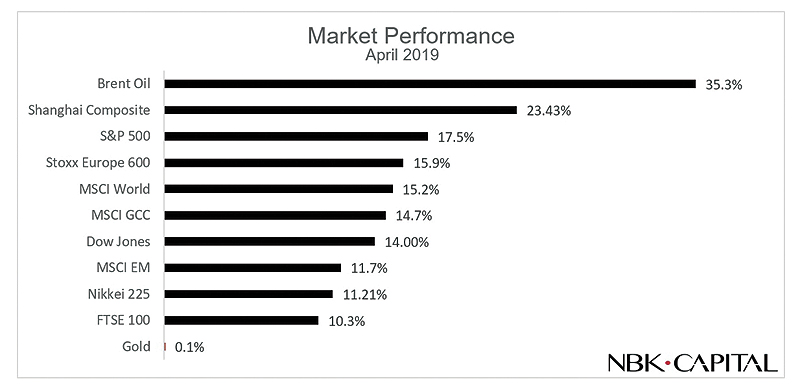

Meanwhile oil continued to rally supported by a combination of factors including the end of the US waivers of Iranian oil imports on May 2, OPEC+ production cuts, the military escalation in Libya, in addition to the worsening political situation in Venezuela. Brent added 6.45 percent in April to close the month at $72.8/bbl, while WTI added 6.27 percent to close April at $63.91/bbl. For the year, Brent and WTI are up 35.32 percent and 40.74 percent respectively.

Emerging markets continued to push forward during April. The MSCI Emerging Market Index added 2.0 percent for a total return of 11.75 percent since the beginning of the year. The MSCI Asia Ex-Japan, on the other hand, reflected the broader outperformance of Asian emerging markets as it added 2.46 percent in April and is now up 11.72 percent for the year. In Turkey, the Borsa Istanbul 100 Index managed to add 1.74 percent during April after very volatile trading last month. It is still, despite the 10.3 percent decline in March, positive for the year at 4.5 percent.

Global Markets climbed higher in April in a continuation of a strong performance since the beginning of the year. The positive performance is supported by solid economic growth in the US and dovish monetary policies from central banks globally, in addition to what appears to be continued progress in the trade talks between the US and China. The MSCI All Countries World Index added 3.2 percent during April and the MSCI Emerging Markets Index was higher by 2.0 percent bringing their year-to-date performance to 15.18 percent and 11.75 percent respectively.

In its latest meeting the Fed kept rate unchanged noting that inflation is below target but it is "transitory", while the economy is growing at a solid rate. Earlier, President Trump continued to be vocal about pressuring the Fed to revert to an accommodative policy. This time suggesting that the Fed should reduce rates by as much as a full percentage point. In the meantime, preliminary numbers for US GDP showed a 3.2 percent growth, exceeding the expectations of 2.0 percent by a big margin. Core Personal Consumption Expenditures (PCE), on the other hand, came in at 1.3 percent lower than the expected 1.6 percent in a further sign that inflation is still weak.

The jump in GDP growth was largely attributed to an increase in net exports accounting for about a third of the increase in GDP, something that analysts attributed to trade wars which caused a decrease in imports. Manufacturing activity decelerated as preliminary numbers of the ISM Manufacturing PMI came in at 52.8 for April compared to 55.3 for the previous month and expectations of 55.0. This would mark the lowest reading since October 2016.

US Indices continued to track higher during the month as the S&P 500 and the tech heavy Nasdaq reached record highs. The S&P 500 closed the month at 2,945.83, up 3.93 percent for April while the Nasdaq was up 4.74 percent at 8,095.39. The Dow Industrial, on the other hand, underperformed with a monthly performance of 2.56 percent. Ten-year treasury yields edged higher during the first 3 weeks of the month to reach an intra-day high of 2.61 percent before retreating back to 2.52 percent at the end of April.

European major indices were higher during April with the Stoxx Europe 600 adding 3.23 percent during the month for a 15.90 percent performance since the beginning of the year. The German DAX was a star performer with a 7.1 percent increase during the month supported by the tech sector and adding 16.91 percent for the year. The French CAC40 added 4.41 percent to bring its performance for the year to 18.09 percent. Manufacturing activity remained weak as the Markit Manufacturing PMI recorded 47.8, marginally higher than the 47.5 for March, while the Markit Services PMI retreated to 52.5 in April down from 53.3 for the previous month. European GDP recorded 1.2 percent for the first quarter while unemployment edged lower to 7.7 percent from 7.8 percent.

UK equities joined the global rally as the FTSE 100 ended the month of April higher by 1.91 percent, bringing its year-to-date performance to 10.26 percent. The Brexit saga, however, is still exerting pressures on the UK economy. The Markit Manufacturing PMI retreated to 53.1 in April down from 55.1 the previous month. In Asia, Japanese equities had a very solid month as the Nikkei 225 advanced by 4.97 percent, bringing its total return for the year to 11.21 percent. Manufacturing activity recovered marginally as the Nikkei Manufacturing PMI increased to 49.5 in April from 49.2. Unemployment registered 2.5 percent in April up from 2.3 percent for March.

Monthly Report of NBKCapital