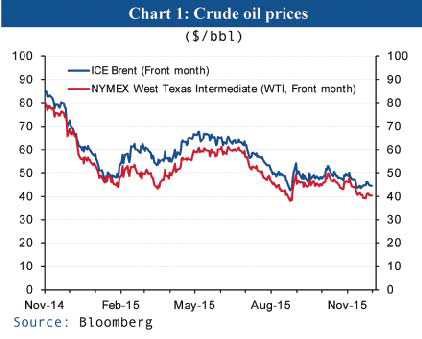

KUWAIT: November saw oil prices remained depressed below the $50 per barrel (bbl) level for the fourth month in a row as the crude supply glut showed no sign of easing. A strengthening US dollar, which rallied to an 8-month high during the month, and a 5 percent decline in Chinese equities added further downward pressure to oil prices. ICE Brent crude, the international benchmark, closed November at $44.5/bbl, while NYMEX West Texas Intermediate (WTI), settled at $41.7/bbl. Both crudes fell by around $5.0, or 10.0 percent, from the start of the month.

KUWAIT: November saw oil prices remained depressed below the $50 per barrel (bbl) level for the fourth month in a row as the crude supply glut showed no sign of easing. A strengthening US dollar, which rallied to an 8-month high during the month, and a 5 percent decline in Chinese equities added further downward pressure to oil prices. ICE Brent crude, the international benchmark, closed November at $44.5/bbl, while NYMEX West Texas Intermediate (WTI), settled at $41.7/bbl. Both crudes fell by around $5.0, or 10.0 percent, from the start of the month.

This is the longest stretch that Brent has traded below $50/bbl since the financial crisis, and comes amid, what the International Energy Agency (IEA) estimates to be, the largest crude surplus in 17 years. Neither the downing of a Russian jet by Turkey nor comments by Saudi officials that the kingdom might move to stabilize prices at December's OPEC meeting managed to chip away at the predominant bearish sentiment. The latter was given extra impetus by continued, counter-seasonal crude stock builds. According to the IEA, commercial crude and petroleum product stocks have swelled to near-record levels of 3.0 billion barrels, which is significantly above historical averages.

OPEC quota

With oil prices firmly range-bound near 6-year lows, markets turned their attention to OPEC and what it might do at its 4 December meeting. The meeting took on added significance in view of Iran's potential return to the oil markets in 2016 and Indonesia's re-admittance to the group after a 7-year absence. Despite speculation that OPEC's de facto leader, Saudi Arabia, might be more amenable this time around to the idea of stabilizing the market, most observers were forecasting policy to remain unchanged; indeed, hedge funds' bets against higher oil prices, for example, reached a year-high in the final week of November, with the volume of short positions increasing to an amount equivalent to 3.5 days of global oil demand.

In the end though, and despite much deliberation at the event, members opted to roll over the group's current 30 mb/d target and to wait until the first half of 2016 before taking any action. By that time, the thinking went, the situation would become clearer; there would be less uncertainty, for example, over the volume of additional Iranian crude coming to the market once international sanctions are lifted. Indeed Iran and Iraq's refusal to accept any limits on production effectively put an end to any possibility of OPEC formalizing production caps or reining in output. Although, at one point, earlier in the meeting, it did seem as if the group might raise its official production target by 1.5 million barrels to 31.5 mb/d to more closely match actual output. By the end of trading on Friday after the OPEC meeting, Brent and WTI crude prices had declined by 1.9 percent and 2.7 percent, respectively.

Since OPEC's decision last November to maintain the official production ceiling, the group's actual output has surged by more than 1 mb/d; OPEC members, led by Saudi Arabia, opted to allow the market to determine prices in the hope that lower oil prices would force higher-cost producers from outside OPEC, such as the US and Canada, to pare back their own production.

OPEC output in October, according to the group's most recent secondary source data, came in at 31.3 mb/d. This was a decline of 260,000 b/d, or 3.2 percent, on the previous month, but nevertheless represented the sixth consecutive month that the group's production had topped 31 mb/d.

Iraq recorded the largest decline in production in October, of 200,000 b/d, to 4.0 mb/d. Bad weather in the northern Gulf, from where the country exports the bulk of its oil, was the primary reason for the decline. Iraqi output had actually climbed to an all-time high of 4.2 mb/d in September. Saudi Arabia and Kuwait also witnessed declines in production compared to September-70,000 b/d and 40,000 b/d, respectively. Kuwait's fall in output to 2.7 mb/d came as a result of scheduled maintenance. The country has been working hard to compensate for the loss of oil from fields the country shares with Saudi Arabia in the divided Neutral Zone. UAE and Qatari production, meanwhile, continued at a steady level, of 2.8 mb/d and 0.7 mb/d, respectively.

Libya, with its increase of 50,000 b/d to 430,000 b/d, witnessed the largest rise in output among OPEC exporters in October. The gain may be temporary, however, as persistent violence and insecurity forced shut the eastern port of Zuetina in early November.

Non-OPEC supply recovers

According to the IEA, non-OPEC supply outside of the US posted healthy gains in October in spite of lower oil prices and capex spending cuts. Chief among non-OPEC producers recording sizeable gains was Russia, the second largest non-OPEC oil producer. The country continued to pump at record levels of almost 10.8 mb/d-1.3 percent more than a year ago-even while the country feels the financial strain of lower oil prices and sanctions. Others including China, Vietnam, Oman and the North Sea producers have also been able to boost output.

Nevertheless, US production, which has been the largest source of non-OPEC supply growth in recent years thanks to the shale oil revolution, has clearly declined over the last 6 months. According to weekly estimates provided by the US Energy Information Administration (EIA), production fell from a 44-year high of 9.6 mb/d last June to 9.2 mb/d as of 27 November, a drop of 400,000 b/d, or 4.0 percent. (Chart 6.) This has come amid cutbacks in capital spending by oil majors and reductions in drilling activity that have seen US oil rig counts plummet by more than 65 percent since reaching a high last October.

The IEA forecasts US shale production to decline by nearly 0.6 mb/d in 2016, which is a fall of more than 10 percent. Shale production accounted for at least 57.0 percent of total US crude production in August. The agency expects total non-OPEC supply growth to therefore reflect this in 2016 and fall by 0.6 mb/d. This would also reverse the increase in supply, of 1.3 mb/d, that is expected to occur in 2015. (Chart 7.)

World demand growth expected to ease towards long-term trend in 2016 after surging to a 5-year high in 2015

On the demand side, the IEA expects the temporary boost to crude demand provided by low oil prices and better-than-expected macroeconomic fundamentals in 2015 to prove transitory and global oil demand growth to ease back to its long-term trend rate in 2016. Thus, after reaching a 5-year high of 1.8 mb/d in 2015, the agency is forecasting that demand growth will decelerate to 1.2 mb/d in 2016.

With crude supply growth expected to tighten to a greater extent than demand growth in 2016, the 'call on OPEC crude' is projected to increase to 31.3 mb/d next year, according to the IEA. This is a rise of 0.2 mb/d from the agency's last projection, bringing the call closer to OPEC's current output of 31.4 and portending somewhat tighter market conditions than in recent months.