KUWAIT: Global markets witnessed a tumultuous Aug-19 with steep volatility pushing the monthly performance into the red for almost all the major financial markets. The broader MSCI World Index was down almost 2.2% during the month taking the biggest hit from emerging markets with the corresponding index sliding more than 5%. The decline came primarily as a result of the unresolved trade war going on between US and China and got support from the Brexit uncertainty, that affected markets across asset classes, including oil, that declined 8.1% during the month.

The month started with the US imposing additional tariffs on China and ended with China countering it with its own set of tariffs on US goods. The confusion over trade war has affected economic growth rates as well as manufacturing activity across countries. On the other hand, the confusion over Brexit continued during the month and in the latest move, the UK PM has requested suspending the UK parliament before the Brexit deadline.

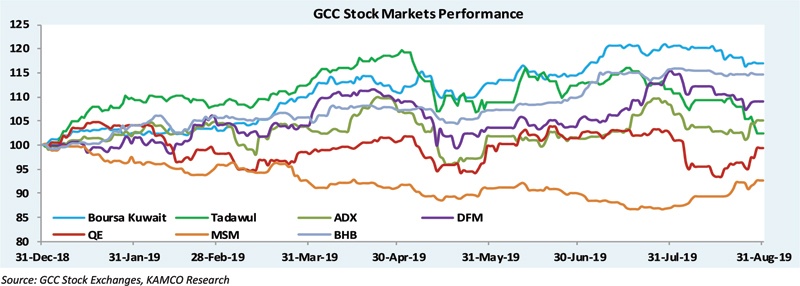

GCC markets saw a relatively bigger impact due to geopolitics and declining oil prices. Saudi Arabia recorded the worst monthly performance with the TASI down 8.2% followed by Dubai that declined 5.5% after recording the best monthly performance during the previous month. The monthly declines pushed TASI's YTD-19 returns down to 2.5% by the end of Aug-19 while DFM stood at 9.0%. Kuwait continues to be the best performing market in the GCC with a YTD-19 return of 17.0% despite sliding 2.9% for the month.

In terms of sectors, all large-cap sectors in the GCC including Real Estate, Banks, Material and Telecom saw mid-single digit declines during Aug-19 partially offset by gains in Utilities, Food and Consumer sectors. GCC trading activity increased during the month despite the Eid holidays. Total value traded during the month reached USD 25.9 Bn during August-19 an increase of 6.5% as compared to the previous month. Trading activity in Saudi Arabia was up 21% that pushed overall trading for GCC higher.

BOURSA KUWAIT

Boursa Kuwait witnessed downward pressure during August-19, in line with most of the GCC markets. All the three Kuwaiti indices witnessed low-single digit declines during August-19 primarily led by large-cap stocks. This was reflected in the 3.2% decline in the Premier Market Index with all the index constituents seeing declines during the month. Integrated Holding in the Premier Market witnessed the biggest decline of 28.4%.

Nevertheless, despite the monthly declines, Kuwait continues to be the best performing market in the GCC in terms of YTD-19 performance with a return of 17% for the All Share Index backed by 23.9% returns for the Premier Market Index, while the Main Market index stood at a marginal growth of 1.1%. The monthly sector performance chart saw all the large-cap sectors declining during the month. The Basic Materials index witnessed the steepest decline of 6.6% due to 10.7% and 4.2% decline in shares of Boubyan Petrochemicals and Qurain Petrochemicals, respectively.

Shares of the two companies declined after Equate Petrochemical, in which both the companies are shareholders, reported a 71% drop in its fiscal Q2-19 profits. The petrochemicals sector has seen declining profitability during Q2-19 due to fall in prices of chemicals and the gloom in global economy.

The Consumer Goods and the Industrials indices were next on the list with declines of 6.1% and 5.6% while the Banking index declined by 2.8%. Shares of all the Kuwaiti banks declined during the month with AUB-Kuwait reporting the biggest drop of 6.4% followed by 6.0% decline for Gulf Bank. Shares of AUB-Kuwait declined after the bank agreed to sell its 75.6% stake in KMEFIC to Hamad Saleh Al Thekair for 58.043 fils per share, as per Reuters.

The monthly gainers chart was topped by Amar for Finance and Leasing with a gain of 50.4% after the company reported profits during 1H-19 as compared to losses during 1H-18. AAN Digital was next on the gainers list with a gain of 25.4% followed by Osoul Investment and KMEFIC with monthly gains of 22.8% and 17.0%, respectively. Shares of KMEFIC gained after the aforementioned deal with AUB-Kuwait.

On the decliners side, Integrated Holding topped with a fall of 28.4% after the company reported a 60% y-o-y drop in profitability during Q2-19. International Resorts was next on the decliners list with a decline of 23.6% followed by IFAHR and Al Masaken International Real Estate with declines of 23.4% and 19.7%, respectively. Trading activity saw a steep decline during the month due to the Eid holidays. Monthly value traded halved to KWD 490 Mn while monthly volumes were down by 45% to 2.6 Bn shares. KFH topped the monthly value chart with KWD 78.8 Mn worth of trades followed by Zain and NBK at KWD 50.7 Mn and KWD 40.9 Mn, respectively.

SAUDI ARABIA (TADAWUL)

Saudi Arabia recorded the worst monthly performance during August-19 in the GCC with the benchmark TASI down by 8.2% to reach the lowest level in eight months. The decline was seen especially during the second half of the month after banking stocks underperformed. The TASI closed the month just above the psychologically important level of 8,000 points at 8,019.77 points resulting in a YTD-19 gain of 2.5% as compared to double digit gains at the end of last month.

The market decline came despite Saudi Arabia becoming a full member of the MSCI after the second phase of inclusion on 28-August-19 that increased the Kingdom's weight in the MSCI Emerging Market index to 2.8%. As per weekly trading activity by nationality, local Saudi and GCC investors were net sellers during the first half of the month as they booked profits when valuations were relatively higher.

On the other hand, foreign investors were net buyers led by the MCSI index inclusion. Nevertheless, dwindling investor confidence due to global economic slowdown and regional geopolitical issues also contributed to the decline. The sector performance trends showed merely three sectors with positive returns during the month including Utilities (+4.0%), Energy (+3.0%) and Consumer Durables & Apparel (+0.5%). In the Utilities sector, SEC recorded a gain of 4.8% during the month after the utilities company said that its subsidiary National Grid SA now has a pan Saudi Arabia transmission network of 84,000 kilometers.

The rest of the sectoral indices witnessed declines in August-19 with the banking index witnessing the steepest monthly decline of 11.7%. Shares of all the 11 banks in the Kingdom declined during the month with nine of them recording double digit declines. Saudi British Bank recorded the steepest monthly fall of 16.8% followed by NCB and Alinma Bank with declines of 11.8% and 11.3%, respectively. Telecom and Materials indices also declined during the month by 7.2% and 6.7%, respectively, further adding to the overall slide in the market. The weakness in the telecom sector came primarily on the back of a 17.1% decline in shares of Zain KSA after the telco and the Saudi Ministry of Finance entered into discussions to convert the telco's outstanding dues to the ministry into shares. In the Materials sector, a majority of the stocks reported declines during the month primarily led by petrochemical names after reporting a steep fall in profitability during Q2-19.

ABU DHABI SECURITIES EXCHANGE

ADX along with its UAE counterpart-DFM which were the best performing GCC indices in July-19 also declined from weak global cues, with the ADX index declining by 2.9% m-o-m. The index closed at 5165.57 points and sectoral performance barring the Consumer Staples segment was negative. The Industrials index was the worst performing sectoral index in Aug-19 with declines of 11.1%, as Gulf Pharmaceutical Industries plunged by 29.8% m-o-m, while Sharjah Cement and Industrial Development receded by 9.4% m-o-m.

Energy names followed as the sectoral index was down 4.8% m-o-m, reflecting global energy price trends that continued to remain under pressure during Aug-19. TAQA was down by 5.8% m-o-m, while the share price of Dana Gas dropped by 5.6% m-o-m. The Real Estate index dropped by 3.3% m-o-m, driven by a 3.0% decline in Aldar, while Sharjah Group (-10%) and RAK Properties (-7.3%) witnessed higher m-om declines in their share prices. Aldar's revenues for H1-19 increased 15% y-o-y to AED 3.42 Bn as compared to AED 2.98 Bn in H1-18, driven by activity on key developments under construction. Net profit for H1-19 came in at AED 969 Mn, down 13% y-o-y from H1-18, primarily owing to legacy one off income events in H1-18.

The Investment & Financial Services index continued its slide in 2019 (YTD: -46.8%) and declined by 1.7% m-o-m in Aug-19. Index constituent Waha Capital reported a net loss of AED 182.2 Mn for H1-19, as the company's Private Investments division recorded a net loss of AED 351.8 Mn for the period, largely due to a provision of AED 209.4 million following a reassessment of the value of AerCap Holding's recoverable amount and a loss on disposal of AED 153.6 million following settlement of 6 million AerCap shares.

QATAR EXCHANGE

After remaining stable in July-19 (+0.5%), Qatar Exchange fell in Aug-19 by 2.6% m-o-m as the QE 20 index closed at 10,232.85 points. The Qatar All Share index which maps the broader market, also exhibited similar declining trends, as the index declined by 3.1% m-o-m for the month. Market breadth was strongly skewed towards decliners, as 36 stocks declined, while only 9 stocks managed to close the month in the green.

Sectoral performance barring the Consumer Goods & Services index was negative. The Insurance index was the worst performing index with declines of 8.9% m-o-m, driven by a 10.3% m-o-m drop in the share price of Qatar Insurance and a 6.3% decline in Doha Insurance. The Real Estate index also plunged by 6.8%, with Ezdan (-9.8%) and Mazaya Qatar (-6.5%) ending Aug-19 as the main laggards. The Consumer Goods and Services index managed to close marginally in the green, as Medicare Group (+7.1%) and Qatar Fuel (+2.1%) witnessed share price gains during Aug-19.

In global index compiler reviews, FTSE Russell included Qatar Fuel to the Large Cap index, Barwa Real Estate to Mid Cap, Al Meera to Small Cap, and Al Salam International and Qatar Oman Investment to its Micro Cap index with changes to be effective from 19 Sept 2019. Separately in its Quarterly review, Qatar Industrial Manufacturing was removed from MSCI's EM small cap index. In terms of earnings, the aggregate earnings of all listed companies on the QSE show a net profit of QAR 19.6 Bn in H1-19, compared to QAR 20.9 Bn for H1-18, which represents a decrease of 6.3% y-o-y. Real Estate player Barwa Real Estate reported a H1-19 net income of QAR 510 Mn, and an EPS of QAR 0.13/share, a y-o-y decrease from H1-18.

The decrease was reportedly due to the decrease in profits of some non-recurring items in nature such as profit from debt scheduling and the application of IFRS 16. Manai Corporation saw its H1-19 revenues increase by 10% yo-y to QAR 5.7 Bn from QAR 5.1 Bn in H1-18. The International Technology segment revenues increased by 17% y-o-y, constituted 80% of the group's H1-19 revenues. Group net profit declined by 47% y-o-y to QAR 88.5 Mn in H1-19.

KAMCO MONTHLY REPORT